FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

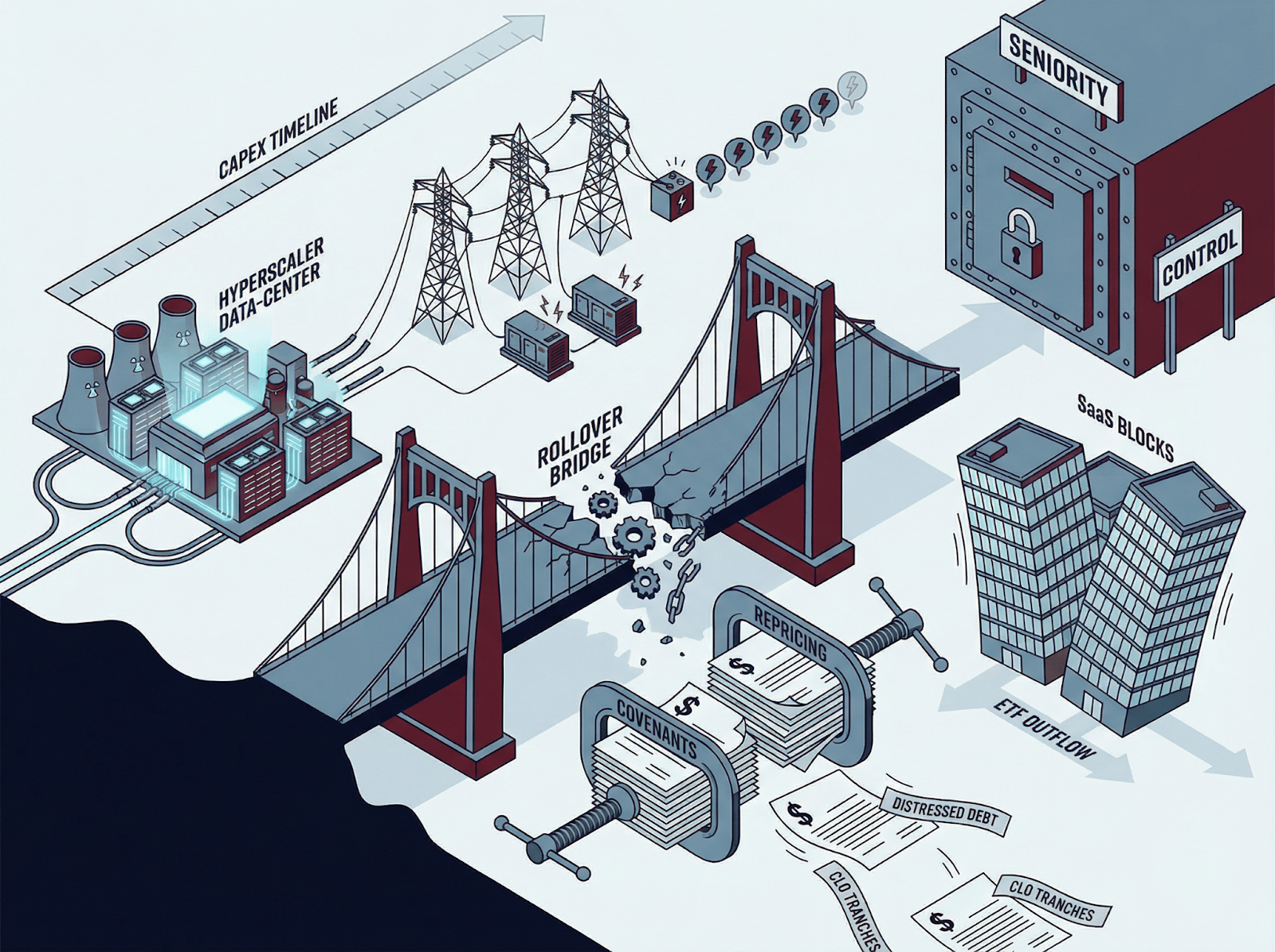

Software loan repricing, hyperscaler capex acceleration, grid reliability constraints, and opportunistic credit rotation are tightening clearance before defaults appear.

THE SETUP

Markets still clear every day.

Equities are noisy, but the deeper change is happening in the machinery underneath them.

AI disruption is no longer just a product story or a multiple story. It is becoming a refinancing story.

The question private markets are being forced to answer is not "who wins" but "who can still be financed" when the underwriting horizon gets shorter and confidence must extend further.

That shift is now visible in credit.

When loan prices move first, terms tighten first. And when terms tighten, the cost of time rises even if marks remain smooth.

PMD Lens

Private markets do not reprice on headlines. They reprice when refinance confidence breaks.

When an industry's durability becomes uncertain, capital does not exit immediately.

It changes instruments.

It shifts toward structures that can survive ambiguity, control outcomes, and price time explicitly.

The stress shows up first in pricing, covenants, and rollover assumptions.

Defaults come later, if they come at all.

WHAT MOST PEOPLE WILL MISS

AI anxiety matters most when it moves from stock prices into loan markets.

Credit markets work slower than stocks.

Loan portfolios reprice through new terms and tougher refinancing talks that take months.

Refinancing is a vote on whether a sector can still get funded years from now. Every loan rollover asks: will lenders still trust this borrower?

Large capex can grow revenue while still crushing returns. Top-line growth doesn't mean good returns when capital needs rise faster than cash flow.

Grid reliability isn't a policy question. It's a financing limit with hard dates.

Projects succeed or fail based on connection times and reliable power under stress.

Market stress doesn't stop capital. It moves capital into safer positions.

Private markets reprice uncertainty through better terms and stronger protections.

PREMIER FEATURE

The Multi-Billion Dollar Scam Nobody's Talking About

Fraud is being exposed everywhere right now. Billions gone.

A legal scam that affects 95% of ALL Americans.

Oxford Club's own Marc Lichtenfeld hit the streets of South Florida to expose it in broad daylight.

Watch along as he captures real people's reactions LIVE on camera.

SIGNALS IN MOTION

Hyperscaler Capex Is Becoming a Duration Test

Amazon's announcement of $200 billion in 2026 capital expenditures came with Q4 earnings and beat analyst targets by $50 billion. The stock fell over 10% after hours.

The market sees a gap. Capital spending speeds up while revenue growth lags.

Markets fund growth when they can model the payback. When investment runs ahead of revenue clarity, lenders shift from story to math.

The question isn't whether AI demand is real. It's whether returns come fast enough to cover the costs and risks. This tension flows through the entire AI financing chain.

Investor Signal: AI infrastructure exposure must be underwritten as a duration trade. If cash conversion lags spend, financing tolerance tightens and return ceilings compress even without demand weakness.

Reliability Cleared. The Constraint Is the Next Peak

Winter Storm Fern left over a million without power across the Southeast. Energy Secretary Chris Wright told data centers to turn on backup generators—collectively holding 35 gigawatts of capacity.

The grid passed the test but showed a structural shift.

Data centers run 24/7 as continuous load. This changes when peak demand hits. Always-on demand removes the seasonal dip that used to give the grid breathing room.

Winter use patterns now look like summer patterns. This shows up in permit wait times, connection queues, and higher prices for reliable power under stress.

Investor Signal: Projects that can secure dispatchable reliability and shorten interconnection timelines retain financing preference. The asset is not just power. It is power that clears under stress.

Disruption Turns Into Opportunity Only Through Structure

Ares Management CEO Michael Arougheti addressed the software selloff during the firm's Q4 earnings call. Software makes up 6% of Ares' total assets. Only a small part faces high AI disruption risk.

More importantly, Arougheti saw the chaos as an opportunity: "Our opportunistic credit and secondaries business should see more investment opportunities, which provides a natural hedge."

Private capital doesn't need certainty to deploy. It needs the ability to structure around doubt.

When outcomes get fuzzy, capital shifts form: equity to debt, primary to secondary, loose terms to tight terms.

Opportunistic credit and secondaries work because they add protection and control to cheap pricing. You position while stories are still unclear, before everyone agrees and prices normalize.

Investor Signal: When disruption risk rises, the best entries often shift from equity optionality to seniority and control. The cycle rewards managers who can buy time with documentation and downside protection.

FROM OUR PARTNERS

DO THIS Before Gold Hits $10K

Gold’s recent run-up has been nothing short of historic — and many experts believe it’s far from over.

Some forecasts now point to gold reaching $10,000 an ounce… with one analyst even projecting $20,000.

But no matter how high gold ultimately goes, it’s critical that you know how to position yourself for the next major move.

DEEP DIVE

AI Disruption Just Became a Loan Market Event

The stress in software isn't showing up as missed payments yet. It's showing up as broken refinancing plans.

Over $17.7 billion of U.S. tech company loans tracked by Bloomberg Intelligence fell to distressed levels in the past four weeks.

This pushed total tech distressed debt to $46.9 billion—the highest since October 2022.

Software-as-a-service companies make up most of this figure. Software loans fell 2.97% in January, their worst showing since September 2022.

Broader loan markets stayed stable.

Loan pricing shows forward financing health, not past results. Lenders must believe today that borrowers can refinance years ahead.

AI-driven risk of being outdated forces markets to price survival odds even when current revenue looks fine. Software makes up 12% of the Bloomberg U.S. Leveraged Loan Index.

Software debt has posted the worst total returns of any sector year-to-date.

Software's market size turns sector stress into system-wide problems. Falling loan prices pressure CLO structures, trigger ETF selling, and raise refinancing bars across related sectors.

Primary market breakdowns are clear: European software company Team.Blue stopped a refinancing last week. Multiple private credit-backed companies now trade 3.5+ points below par.

Private markets respond in order. Spreads widen and terms get tighter first.

Refinancing windows shrink and sponsor support becomes explicit next.

Then capital picks winners: businesses with unique data, vertical ties, and switching costs keep access. Generic tools and highly leveraged structures lose appeal.

Things get worse through refinancing friction before defaults hit.

UBS estimates 25-35% of private credit faces AI disruption risk. Default rates could hit 13% in tough scenarios versus 4% for high yield.

Yet private credit portfolios in Business Development Companies show stable marks, creating a value gap with liquid secondary markets.

This gap brings both risk and opportunity based on stack position and term quality.

Deep-Dive Investor Signal: The market is pulling forward the refinance vote. AI is forcing lenders to underwrite not current performance but future financeability. When that belief wavers, time becomes expensive and the weakest business models lose rollover access first.

FROM OUR PARTNERS

The #1 Memecoin Opportunity to Start the New Year

While the broader crypto market struggled, analysts Brian and Joe kept finding explosive memecoin gains — including 1,100% in 2 days, 600% in a single day, and even 8,200% in months.

These weren’t lucky bets. They use a proprietary system designed to spot memecoins with momentum before they take off, regardless of market conditions.

Now they’ve identified their #1 memecoin for February 2026. It’s still trading at pennies, with viral potential, real utility, and a setup that could thrive if a New Year rally takes hold.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

THE PLAYBOOK

Underwrite refinance confidence as the primary variable, not current earnings stability.

Stress test portfolio companies against a higher spread regime and shorter extension tolerance.

Separate "AI beneficiary" from "AI financeable" by modeling rollover demand and lender appetite.

Favor credit exposure where documentation, covenants, and control rights price disruption explicitly.

Treat grid access and dispatchable reliability as gating diligence items for digital infrastructure.

Expect dislocation to shift entry points toward secondaries and opportunistic credit rather than primary growth equity.

THE PMD REPOSITION

Private markets are not repricing on headlines. They are repricing on clearance.

As AI uncertainty migrates into loan pricing, the market is pulling forward the refinance test and charging for time.

Hyperscaler capex is lengthening payback profiles even as demand remains real, while grid reliability constraints turn infrastructure timelines into underwriting variables.

Capital will still deploy, but it will do so through heavier structures, tighter terms, and more emphasis on control.

PMD is positioned for a market where disruption shows up first in refinancing, reliability, and structure, and where the decisive edge is knowing what will still clear before the marks move.