Private markets are adjusting to longer holds, tighter exits, and rising control battles as capital migrates toward patience, pricing power, and resilience.

MARKET PULSE

Private markets are absorbing a constraint public markets can still defer: time.

Exit congestion in private equity is stretching hold periods and compressing capital recycling, while patient capital is concentrating around assets that can compound without liquidity pressure.

Control is resurfacing as growth cools, governance replaces momentum, and operating leverage tightens at the business level.

From infrastructure to consumer brands to restaurants, the signal is consistent. Capital is repricing durability over velocity.

The next phase rewards ownership structures that can sit longer, absorb margin pressure, and operate without forced decisions.

PREMIER FEATURE

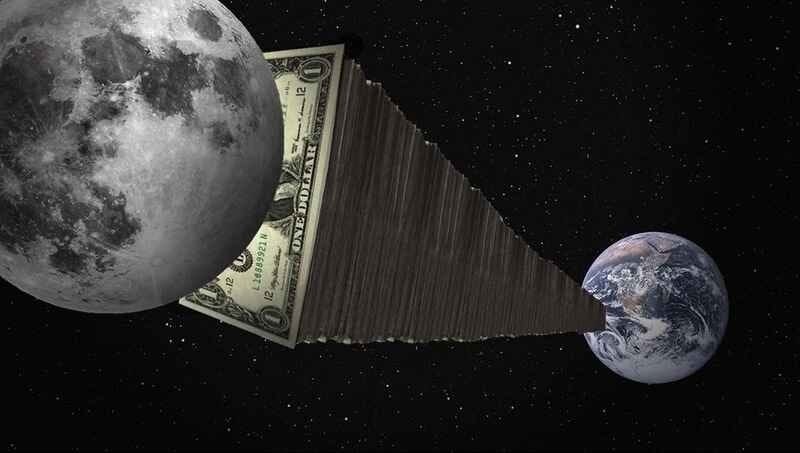

The Crypto That Survived the Crash—and Came Out Stronger

The recent crash wasn’t just a selloff. It was a stress test. Weak projects cracked. Overleveraged traders got wiped out. Fear ruled the market.

While prices across the market collapsed, this coin’s on-chain activity actually surged—more users, more transactions, more real demand. That kind of divergence doesn’t happen by accident. It’s a signal of strength the market hasn’t fully priced in yet.

We’ve seen this setup before. And it led to gains of 8,600%, 3,500%, and 1,743%.

Now the selling pressure is fading—and the next leg higher could come fast.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

QUICK BRIEFS: SOFTBANK TARGETS DATA CENTERS | FOUNDERS RETAKE CONTROL | RESTAURANTS TRADE MARGIN

SoftBank Circles Digital Infrastructure as Duration Becomes Power

Control is moving toward capital that can wait.

Reports that SoftBank is in advanced talks to acquire DigitalBridge triggered a sharp rally, but the signal runs deeper than deal speculation.

This is capital consolidating around assets designed to compound slowly, throw off durable cash flow, and tolerate long holding periods without exit pressure.

Digital infrastructure fits that mandate.

Data centers sit at the intersection of AI demand, power access, and global scale. They reward ownership stability more than financial engineering.

As private equity faces pressure to recycle aging portfolios, strategic capital with fewer liquidity constraints is stepping in to own, not flip.

The gap between capital that must exit and capital that can hold is widening. In that gap, price discovery is shifting. Scarcity is not compute. It is patience.

Investor Signal

Long-duration assets are being repriced by who can own them longest. Exit pressure is becoming a structural disadvantage. Control is concentrating with capital that treats time as an asset.

Founder Control Reemerges as Governance Replaces Growth

Control doesn’t disappear when companies go public. It waits.

Financial tools lose force late in the cycle. Boards, mandates, and strategic direction take over.

Concentrated ownership allows founders and large holders to treat public companies like private control assets, prioritizing legitimacy and reset over speed or consensus.

This is not activist noise. It is structure asserting itself after momentum fades. Public listings do not erase control dynamics. They often delay them until conditions force a reckoning.

For markets, the implication is clear. Governance risk does not shrink with maturity. It resurfaces when performance can no longer carry the story.

Investor Signal

Control risk survives liquidity events. Governance becomes decisive when growth decelerates. Public does not mean dispersed.

Restaurants Trade Margin for Volume as Elasticity Hardens

Pricing power is breaking before demand does.

Restaurant chains leaned aggressively into value offerings through 2025, and that posture is extending into 2026.

From McDonald's to casual dining peers, operators are defending traffic as consumers become more price sensitive, even while labor and input costs stay elevated.

This is not promotional behavior. It is structural adaptation.

Operators are choosing relevance over margin, absorbing macro pressure internally rather than passing it through. Volume now clears where pricing cannot.

That tradeoff mirrors what private markets are seeing across consumer-facing assets. Businesses with genuine pricing power remain insulated.

Those without it are forced to compete on affordability, compressing returns to preserve share.

Demand still exists. The ability to monetize it cleanly does not.

Investor Signal

Volume is being protected at the expense of margin. Pricing power is the real differentiator. Elasticity is setting the return ceiling.

FROM OUR PARTNERS

The NEXT Trillion Dollar Company?

It just signed a deal to get its tech in Apple's iPhone until 2040! Online commenters are debating if this brand-new company will be the 7th trillion dollar stock.

DEEP DIVE

Private Equity’s Exit Backlog Is Becoming a Structural Constraint

The bottleneck is no longer deal flow. It is clearance.

Private equity made visible progress exiting assets in 2025, enough to revive optimism and reopen selective windows. But beneath the headlines, inventory is still building.

That is not a pause. It is a change in operating conditions.

The model depends on motion. Exits recycle capital, support DPI, and anchor fundraising narratives.

When assets linger, the flywheel slows.

Fees stretch thinner, carry drifts further out, and successor funds become harder to justify. A handful of IPOs does not solve this for the median portfolio company that cannot clear public-market standards.

Dry powder obscures the congestion. Undeployed capital creates the illusion of flexibility, but it does nothing to relieve capital already locked inside aging deals.

Firms are now managing opposing pressures at once: deploy new funds while avoiding the crystallization of losses on old ones. That tension is structural, not cyclical.

The response is already reshaping the industry.

They are becoming core mechanisms for managing duration without forcing bad exits.

The competitive gap is widening between firms with flexible capital, newer vintages, or patient co-investors… and those without.

What emerges in 2026 will not be a broad exit boom.

It will be selective clearing. Premium assets will move. The rest will be refinanced, warehoused, or restructured.

The question is no longer when markets reopen. It is whether the model can function smoothly with structurally longer holds.

Investor Signal

Exit velocity is becoming a binding constraint, not a timing issue.

Portfolio duration is now a risk variable that shapes fundraising, fees, and strategy. The advantage shifts to managers who can operate profitably with capital that stays put longer.

FROM OUR PARTNERS

Investors Are Watching This Fast-Growing Tech Company

No, it's not Nvidia… It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They’ve just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

THE PLAYBOOK

This is a cycle for capital that can wait. Liquidity optionality, governance leverage, and balance-sheet endurance matter more than rapid turnover.

Managers with flexibility around duration can clear deals others cannot, while operators with pricing power and cost discipline outlast those reliant on volume alone.

Speed is no longer the edge.

Staying solvent, relevant, and in control is. Capital that accepts slower exits and higher friction gains access where urgency becomes a liability.