Washington formalizes the gates around money, chips, platforms, and scale

MARKET PULSE

Permission Is Becoming a Balance Sheet Variable

Private markets are learning what public markets have been pricing for months: capital does not disappear under pressure. It reroutes, reclassifies, and resubmits.

This week’s signals converge on a single shift. Governments are no longer trying to stop capital from flowing into sensitive systems. They are deciding who gets to participate, where, and under what conditions.

Investment is no longer a binary allowed or prohibited. It is conditional.

Access now sits inside legal frameworks, interagency review, national-security tolerance, and jurisdictional structure. For private capital, that changes underwriting, timelines, and exit math.

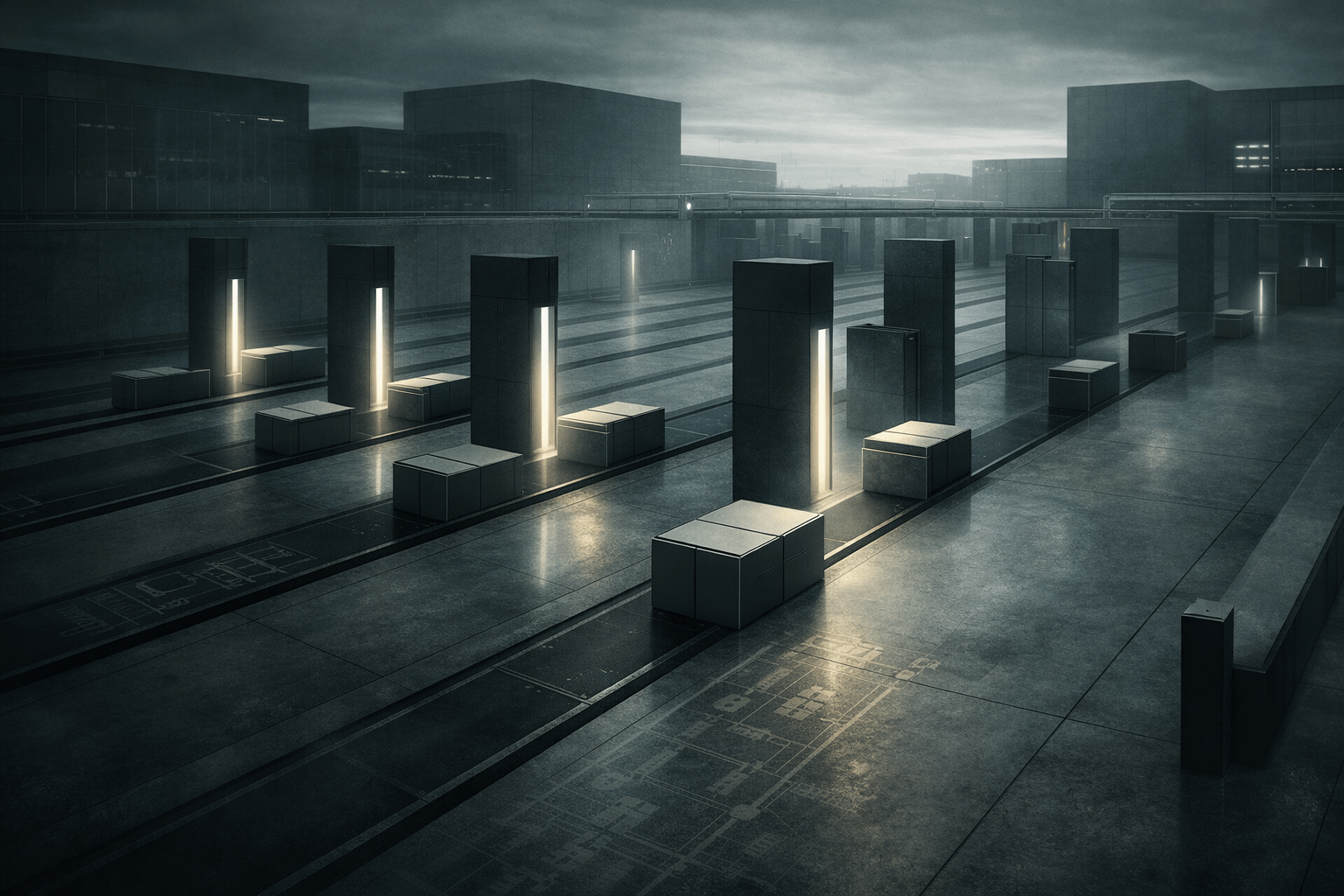

This is not deglobalization.

It is gated globalization.

PREMIER FEATURE

America’s Top Billionaires Quietly Backed This Startup

When billionaires like Jeff Bezos and Bill Gates back an emerging technology, it’s worth paying attention.

That’s exactly what’s happening with a little-known company founded by an ex-Google visionary. Alexander Green calls it “one of the most overlooked opportunities in AI right now” — and he’s even an investor himself.

He’s now sharing the full story, including why early investors are watching closely and why he believes widespread adoption could be just one announcement away.

QUICK BRIEFS: AI CLEARANCE | PLATFORM RESTRUCTURING | CAPITAL AT SCALE

NVIDIA: AI COMPUTE BECOMES A LICENSED PRODUCT

The Trump administration has launched an interagency review that could allow Nvidia to resume sales of advanced H200 AI chips to China, reversing prior restrictions under a managed licensing regime.

This is not a rollback of controls. It is a refinement.

The U.S. is signaling that access to advanced compute will be metered, reviewed, and monetized, not simply denied. Proposed sales would carry oversight and a direct fee. Export permission becomes a toll, not a wall.

AI chips are no longer commercial inventory. They are strategic assets cleared transaction by transaction.

Investor Signal

AI infrastructure assumptions must incorporate licensing risk as a throughput constraint. Compute availability will increasingly depend on political clearance, not manufacturing capacity. This favors vertically integrated players with regulatory leverage and disadvantages systems built on unrestricted global distribution.

TIKTOK: JURISDICTION AS A CORPORATE STRUCTURE

TikTok’s creation of a U.S.-based joint venture marks the most explicit example yet of jurisdiction reshaping platform ownership.

The solution was not divestment in the traditional sense. It was architectural. Majority American ownership. U.S. governance. Domestic data custody. Algorithm retraining on local data.

This sets a precedent. Platforms that sit at the intersection of data, influence, and foreign control will increasingly be required to localize governance to retain market access.

Investor Signal

Geography is now a design decision. Platforms exposed to national-security scrutiny will need to restructure ownership, data flows, and control layers to maintain clearance. Value accrues to firms that can modularize operations across jurisdictions without breaking core economics.

OPENAI: SCALE IS NO LONGER JUST A FINANCING QUESTION

OpenAI’s attempt to raise up to $100 billion at a valuation approaching $830 billion highlights how AI development has crossed from venture scale into sovereign scale.

This is not traditional growth capital. It is infrastructure funding.

The size of the round implies dependence on sovereign wealth, geopolitical alignment, and long-duration tolerance for capital burn. As AI models grow more expensive to train and deploy, funding sources narrow.

At this scale, capital is not neutral. It carries expectations around influence, access, and alignment.

Investor Signal

AI leaders are moving beyond venture logic into state-adjacent financing. Capital structure will increasingly shape strategic freedom. The winners will not be those who raise the most, but those who can secure funding without surrendering operational or geopolitical flexibility.

FROM OUR PARTNERS

They’ve Cracked the Memecoin Code

What if you could spot the next 8,200% memecoin before it explodes?

Most think memecoin gains are luck — but our team’s proprietary system has repeatedly identified breakout coins that surged 4,915%... 3,110%... even 8,200%.

They’ve just flagged a new pick triggering all their top signals — and it could be the next major move.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

DEEP DIVE

OUTBOUND CAPITAL TO CHINA MOVES FROM FRICTION TO FORMAL CONTROL

The U.S. has crossed a line it spent years debating.

With the passage of the National Defense Authorization Act, Washington has formally codified the power to screen, monitor, and block U.S. investment into Chinese technology companies tied to military, surveillance, and dual-use applications.

This is no longer executive improvisation.

It is statute.

For the first time, outbound investment is treated as a national-security surface on par with exports, sanctions, and trade controls. Capital itself is now considered a strategic input.

The scope matters. The law does not simply ban deals. It establishes a permanent review regime. Some transactions will be blocked. Others will require notification. Many will proceed only under scrutiny.

In practice, this turns minority stakes, licensing structures, and downstream exposure into regulatory variables rather than purely financial ones.

The clearance is bilateral; while Washington has set the toll, Beijing’s willingness to allow domestic firms to pay it remains the final hurdle to revenue realization.

That distinction is critical.

For decades, American venture capital, pension funds, and asset managers helped build China’s semiconductor, AI, and hardware ecosystems under the assumption that commercial progress was politically neutral. That assumption is now formally rejected.

The new framework blends multiple enforcement tools. Entity lists. Sector definitions. Sanctions-style authority. Mandatory disclosures. The result is a flexible system that can tighten or relax without rewriting the law.

For private markets, the consequence is structural.

China exposure now carries regulatory optionality risk. Deals that appear compliant today can be revisited tomorrow. Minority stakes, passive exposure, and downstream partnerships all face review if they touch designated technologies.

Capital allocation models that once focused on growth rates and margins must now price legal durability and political tolerance.

The deeper signal is directional.

The U.S. is no longer reacting to China’s technological rise. It is attempting to govern how much of that rise is financed, enabled, or accelerated by Western capital.

Trade wars targeted goods.

This targets funding.

Investor Signal

Outbound investment into strategic technology is no longer a free variable. Capital planning must assume review, delay, and potential retroactive scrutiny. The advantage shifts to firms that can localize exposure, structure around jurisdiction, or redeploy capital without headline dependency on restricted geographies.

FROM OUR PARTNERS

Investors Are Watching This Fast-Growing Tech Company

No, it's not Nvidia… It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Their disruptive tech has helped users earn and save $325M+, driving $75M+ in revenue and 50M+ consumer base. They’ve just been granted the stock ticker $MODE by the Nasdaq and over 56,000 investors participated in their previous rounds.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

THE PLAYBOOK

Across capital, technology, and platforms, the pattern is consistent.

Investment is screened, not stopped.

Compute is licensed, not free.

Platforms survive by restructuring jurisdiction.

Scale requires political tolerance, not just capital availability.

Private markets are entering an era where permission is cumulative. Each layer of access depends on alignment across regulators, security agencies, and national priorities.

The next advantage is not speed.

It is clearance.

In this cycle, growth belongs to those who understand where capital is allowed to go, how long approval takes, and which structures survive scrutiny.

Capital still moves.

But only through the gates.