The world’s largest grid is becoming the foundation of its AI strategy

MARKET PULSE

The AI arms race is shifting from chips to electricity.

Compute ambition now depends on who can deliver steady, cheap, abundant power long before new fabs or model architectures arrive.

The U.S. is scrambling to secure electrons. Europe is behind.

China has spent a decade building an oversize grid designed for heavy industry and national planning. Now that infrastructure is being repurposed for AI at a scale no other country can match.

This is the first meaningful structural divergence in AI capability since the semiconductor export controls.

The question is no longer who has the best models. It is who can power them.

FROM OUR PARTNERS

The Crypto Forecast I Wasn’t Supposed to Share

For years, I’ve interviewed billionaire founders, hedge fund managers, and early Bitcoin insiders.

But recently, behind closed doors, they all started preparing for the same thing — an event they believe could trigger the biggest wealth transfer in crypto history.

After 600 insider interviews and 17 million podcast downloads, I finally connected the dots and revealed everything in my new book Crypto Revolution — now FREE.

Inside, you’ll see:

• Why insiders believe Bitcoin could reach $300,000

• The hidden accumulation pattern forming right now

• And the “point of no return” most people won’t see coming

Once this goes mainstream, the early edge disappears.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

QUICK BRIEFS

DISNEY PUTS $1 BILLION INTO OPENAI AND OPENS ITS IP TO SORA

Disney will invest $1 billion into OpenAI and grant a three-year license allowing Sora users to generate short AI videos using more than 200 Disney, Marvel, Pixar, and Star Wars characters. A curated selection will appear on Disney+. ChatGPT Images will also gain controlled access to the same library.

The move follows a wave of legal pressure from Disney toward major AI companies, including newly surfaced claims against Google for large-scale copyright misuse. The OpenAI deal represents the “carrot” to that “stick.”

Disney is positioning AI as a distribution and engagement channel rather than a threat, while giving OpenAI a credibility boost in regulated content. Both sides need predictable rules of the road.

Investor Signal

IP holders are shifting from defensive lawsuits to structured participation. The next advantage lies with platforms able to create compliant, controlled content ecosystems that keep rights holders inside the tent. Costs will rise for models operating outside these partnerships.

STANFORD’S ARTEMIS BOT OUTPERFORMS MOST HUMAN PEN TESTERS

Stanford researchers released Artemis, an AI penetration tester that scanned, identified, and exploited network vulnerabilities on a live Stanford engineering network. Artemis beat nine of the ten human testers it was benchmarked against.

The tool found valid bugs at high speed and low cost, though it generated false positives and missed at least one obvious issue that humans caught. Even so, its performance shows the gap between theoretical AI hacking and real-world capability is closing fast.

Security leaders now face a double pressure point: AI allows defenders to test more software more frequently, but it also enables attackers to scale exploit discovery at unprecedented volume.

Investor Signal

Software risk is entering a new regime where vulnerability discovery becomes automated. Insurers, auditors, cloud providers, and critical-infrastructure operators will need new frameworks. The advantage shifts toward organizations that can continuously test and remediate, not those relying on periodic human audits.

ORACLE DROPS ON BIG EARNINGS BEAT AND BIGGER CAPEX

Oracle delivered adjusted EPS of $2.26 versus $1.64 expected, driven largely by the sale of its Ampere chip stake. Revenue came in slightly light at $16.06 billion.

The stock fell after the company lifted full-year capital expenditures from $35 billion to $50 billion and signaled sustained investment in cloud infrastructure tied to hyperscaler demand and OpenAI commitments. Margins continue to compress as cloud revenue grows.

The multiyear backlog now stands at $523 billion, but the cost to deliver that backlog is rising faster than investors anticipated. Oracle must spend heavily to be relevant in the compute-and-storage race powering AI workloads.

Investor Signal

The market is recalibrating around the economics of cloud infrastructure. The winners in AI-driven demand will be those able to finance, build, and monetize massive data center buildouts without exhausting balance sheets. Cash flow resilience is becoming the new moat.

FROM OUR PARTNERS

[How To] Claim Your Pre-IPO Stake In SpaceX!

This is urgent, so I’ll be direct…

For the first time ever, James Altucher – one of America’s top venture capitalists – is sharing how ANYONE can get a pre-IPO stake in SpaceX… with as little as $100!

In other words, this is your first-ever chance to skip the line, and get in BEFORE Elon Musk’s next IPO takes place.

Best of all, it couldn’t be any easier…

When you act today, you can get a pre-IPO stake right inside your regular brokerage account, all with just $100 and a few minutes of time.

All you need is the name and ticker symbol that James reveals for FREE, right inside this short video.

DEEP DIVE

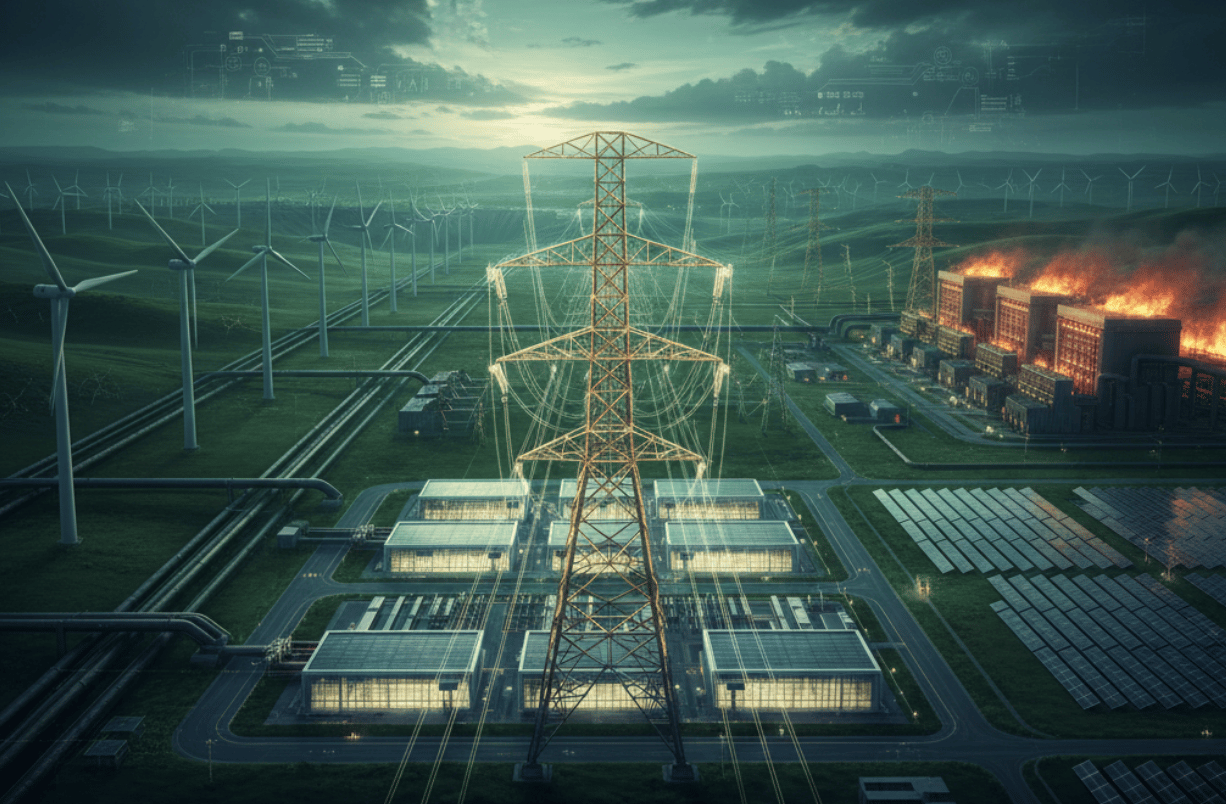

HOW CHINA BUILT THE POWER ADVANTAGE BEHIND ITS AI STRATEGY

The visible difference between U.S. and Chinese AI systems is compute access. The deeper separation is energy.

China built the world’s largest power grid over two decades, originally designed for industrial loads that never fully materialized. That surplus capacity is now being converted into a national AI accelerant.

Surplus Power at a National Scale

China generated more than twice as much electricity as the U.S. last year, with enough planned investment to widen the gap. Inner Mongolia, Gansu, Sichuan, and Xinjiang now host clusters of wind, solar, hydro, and coal plants feeding into ultrahigh-voltage lines that can carry power thousands of miles.

This is not a marginal advantage. It is scale that reshapes cost curves. Some data centers in China now pay a third of U.S. rates under long-term agreements, giving local AI developers economic room to run large-model workloads continuously.

Bundling Chips to Overcome Chip Limits

China cannot match NVIDIA’s cutting-edge chips. Instead, it bundles hundreds or thousands of domestic chips into compute clusters that approach competitive performance.

The tradeoff is electricity. Bundled systems may consume multiple times the power of Blackwell-class GPUs. China’s grid absorbs the excess. U.S. grids cannot.

For now, this strategy is messy and inefficient. But it works well enough to keep Chinese AI development on track despite export controls.

A National Cloud as Policy

China’s “East Data, West Computing” initiative links western power to eastern demand through designated AI hubs. Local governments subsidize electricity. The central government standardizes approvals.

The aim is not to build isolated data centers. It is to create a coordinated, nationwide compute pool by 2028.

No Western country is attempting something similar.

The Real Risk

U.S. hyperscalers are facing multi-year power shortages, grid constraints, and permitting delays. China is facing none of those barriers at scale.

The gap is not yet destiny, but it is a structural divergence.

Investor Signal

The next phase of AI competition will be defined by access to firm power. The U.S. has better chips and better models. China has more electricity and more grid. If both trends continue, advantage will hinge on who closes their deficit first: China in semiconductors or the U.S. in power.

FROM OUR PARTNERS

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

THE PLAYBOOK

The bottleneck has moved.

AI is no longer constrained by the quality of models or the availability of GPUs. It is constrained by power systems designed for a different era.

China is building AI on top of unused industrial capacity. The U.S. is trying to build AI through grid upgrades that take years.

The systems will converge eventually, but they will not converge soon.

For investors, the signal is simple.

The frontier of AI is moving into energy, infrastructure, and transmission.

The next competitive edge will belong to whoever can deliver electrons as reliably as compute.