Markets aren’t repricing growth. They’re repricing trust, enforcement, and who controls the rulebook when duration, credit, and access collide.

MARKET PULSE

Private markets are starting to price institutions, not just assets.

The Fed probe pushed term premium higher without a classic risk-off bid, signaling that credibility itself is now a variable.

That same dynamic is showing up elsewhere.

Multifamily sponsors defend value through concessions instead of cuts. Consumer credit absorbs policy threat before defaults arrive. Energy markets reprice custody and compliance rather than production.

Capital hasn’t disappeared.

It’s becoming selective about where rules are stable enough to underwrite time.

Duration still clears… but only where governance holds.

PREMIER FEATURE

Your Portfolio May Be Missing the Next Magnificent Seven

If you own none of the next generation of AI leaders, your portfolio could be more exposed than you realize.

The original Magnificent Seven turned $7,000 into $1.18 million.

But according to one veteran investor, the next seven could play out far faster — potentially in six years, not twenty.

Why?

Because AI adoption is accelerating at a pace we’ve never seen before.

Now, the analyst who identified Nvidia back in 2005 is revealing the seven AI stocks he believes are positioned to lead the next wave — free for a limited time.

QUICK BRIEFS

Sunbelt Rent Concessions Signal Where Multifamily Clears First

Phoenix isn’t cutting rent. It’s cutting time.

More than half of new high-end apartment properties are now offering a month or more of free rent as supply peaks across the Sunbelt.

Developers are defending face rents while quietly letting cash flow absorb the hit. That distinction matters. Lenders underwrite headline numbers. Sponsors manage reality through concessions.

This is the first stage of repricing. Incentives clear vacancy without triggering appraisal resets, covenant pressure, or lender conversations.

But it comes at a cost. DSCR weakens. Refi math tightens. Extension risk creeps forward even as pricing looks stable on paper.

The split is widening. New luxury supply clears through giveaways. Older workforce housing holds firmer because replacement inventory isn’t coming behind it.

The next year isn’t about where rents land. It’s about how long absorption takes before sponsors run out of flexibility.

Concessions buy time. They don’t solve leverage.

Investor Signal

Cash flow is being sacrificed to preserve valuation optics. Absorption speed now matters more than rent growth assumptions. Assets without time buffers will surface first.

Credit Card Rate Caps Put Consumer Credit On Notice

Policy risk just entered consumer lending from the front door.

Trump’s call for a one-year 10% cap on credit card APRs immediately pressured bank stocks, not because the proposal is detailed, but because the signal is clear.

Pricing power is now a political variable.

An APR cap doesn’t eliminate risk. It redistributes it. Underwriting tightens. Marginal borrowers lose access. Issuers compensate through fees, product redesign, or balance transfers.

Credit still clears, just less evenly and with more friction embedded upstream.

For private markets, the exposure isn’t theoretical. Consumer ABS structures, fintech originators, and private credit sleeves tied to receivables all depend on pricing flexibility.

Even if legislation stalls, optionality has been introduced into a segment long treated as stable plumbing.

When returns depend on regulatory tolerance, duration gets shorter.

Investor Signal

Consumer credit is no longer priced as politically neutral. Fee structures will matter more than headline yields. Policy optionality is now part of underwriting.

Dark Oil Enforcement Turns Access Into The Scarce Commodity

Oil isn’t disappearing. It’s getting harder to move.

U.S. enforcement against sanctioned “shadow fleet” tankers is escalating, disrupting the flow of discounted crude China has relied on from Iran, Russia, and Venezuela.

This is where repricing actually happens. Not in spot benchmarks, but in logistics, insurance, trade finance, and refinery margins. When vessels get boarded and cargoes seized, the risk migrates from price to custody.

The sanctioned market is now large enough that interference creates ripple effects even when official supply looks ample.

Clean barrels gain value. Clean counterparties gain leverage. Compliance stops being overhead and starts being an asset.

Capital tied to shipping, storage, or sanction-adjacent flows is now underwriting enforcement, not demand.

Investor Signal

Access risk is overtaking production risk. Logistics and compliance are becoming price drivers. Clean supply chains command a growing premium.

FROM OUR PARTNERS

7 market signals flashing red right now

Every major economic collapse looks “normal” right up until it doesn’t.

Right now, the same 7 key indicators that warned ahead of 1929, the 1970s stagflation, and the 2008 crisis are flashing red at the same time — yet most Americans don’t even know they exist.

Inside The Bellwether Signal, you’ll see why market patterns can be misleading and how some investors are positioning before stress hits the system — including why many are moving part of their savings into gold and silver IRAs, assets that have historically held up when others failed.

DEEP DIVE

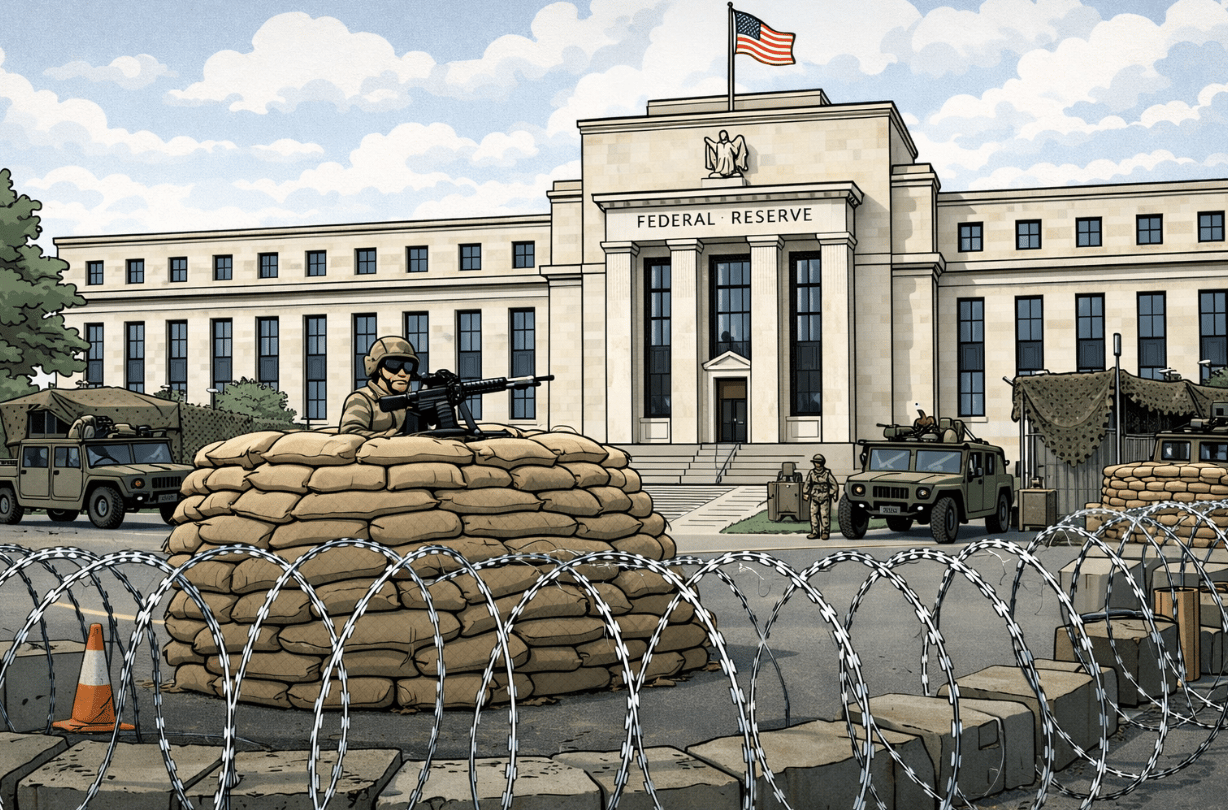

Fed Independence Just Became A Tradable Market Input

That combination points to term premium, not panic.

Markets weren’t running from risk. They were repricing the rules.

Private capital doesn’t underwrite central bankers as individuals.

It underwrites frameworks.

Credibility.

Predictability.

Legal distance from politics.

Once that perimeter looks penetrable, duration stops being a macro call and starts behaving like an institutional one.

That shift shows up first where PMD readers feel it. Long-dated assets price off confidence that guidance will hold.

If independence is conditional, hedging costs rise even if policy rates eventually fall. Real estate, private credit, and infrastructure all feel this through higher all-in capital costs, not headline rates.

A cut cycle can coexist with tighter financial conditions if the rule set feels unstable.

The second-order effect is process risk.

Policy signaling used to clear through speeches and dots. Now it risks clearing through subpoenas, courts, and investigations.

That moves uncertainty upstream. Investors start demanding more compensation for anything reliant on forward guidance holding steady over time.

The timing compounds it. Powell’s chair term ends in May.

Succession normally reads as philosophy. This one reads as exposure. Confirmation mechanics, enforcement optics, and institutional boundaries are now inputs into issuance windows and refinancing decisions.

Capital doesn’t wait for clarity when the framework itself is in question. It shortens.

This isn’t a crisis moment. It’s a pricing one. The Fed’s tools still work. The question markets are asking is who gets to touch them, and how.

Investor Signal

Term premium is responding to governance, not growth.

Duration is quietly becoming a confidence trade.

Institutional process now carries a risk premium.

When independence is questioned, patience costs more.

FROM OUR PARTNERS

10 AI Stocks to Lead the Next Decade

AI is fueling the Fourth Industrial Revolution – and these 10 stocks are front and center.

Another leads warehouse automation, with a $23B backlog – including all 47 distribution centers of a top U.S. retailer – plus a JV to lease robots to mid-market operators.

From core infrastructure to automation leaders, these companies and other leaders are all in The 10 Best AI Stocks to Own in 2026.

Free today, grab it before the paywall locks.

THE PLAYBOOK

This is a market that punishes assumptions of neutrality.

Discount rates now carry governance risk. Cash flows are stress-tested against policy optionality. Access matters as much as price.

Across credit, housing, and commodities, the winners aren’t those chasing yield… they’re the ones who can absorb friction without breaking the structure.

Duration is still investable, but it requires confidence in institutions, enforcement paths, and legal insulation.

The moat is no longer speed or scale. It’s tolerance for rule-set uncertainty while capital waits.