Nuclear shipping, structured IPOs, and rising energy costs all point to the same reality. Capital is no longer priced on speed or scale. It is priced on how long it can hold.

MARKET PULSE

Markets Are Still Liquid. Projects Are Not.

Public markets continue to behave as if optionality is intact.

Equities are stable. Credit spreads remain orderly. Risk appetite has not collapsed.

But beneath the surface, the friction is compounding.

Across private markets, infrastructure, and capital intensive systems, the constraint is no longer access to capital. It is the ability to commit it for long periods without forced repricing.

Duration is stretching. Payback is moving outward. Policy and operating uncertainty are becoming permanent inputs rather than temporary shocks.

This is not a pullback from growth. It is a repricing of timelines.

Capital is shifting toward structures that can absorb delay, regulation, and uneven utilization without breaking their economics.

Liquidity still exists. Clearance is becoming selective.

PREMIER FEATURE

Trump's Secret Retirement Fund

His salary is $400,000 a year. But his tax returns show he collects up to $250,000 a MONTH from one source.

It's not real estate.

It's not stocks.

QUICK BRIEFS

Macro Tailwinds Support Growth, But Only for Capital That Can Wait

Tax cuts, fading tariff uncertainty, and late cycle rate cuts are setting the stage for stronger headline growth in 2026. AI related capex continues. Fiscal impulse is real.

But this is not a return to frictionless expansion.

Labor markets are softening unevenly. Inflation risks persist. Policy clarity remains conditional.

The benefit accrues disproportionately to businesses and investors that can commit through volatility rather than trade around it.

This is supportive macro, not forgiving macro.

The upside belongs to capital that can stay deployed when timelines stretch and execution remains lumpy.

Investor Signal

Macro stimulus rewards duration, not agility. The advantage shifts to balance sheets that can tolerate delay without requiring precision timing.

Public Investors Are Buying Structure, Not Earnings, in Andersen’s IPO

Andersen’s public debut highlights a familiar pattern. Economic ownership, voting control, and cash flow rights do not sit with the same holders.

Up C structures, tax receivable agreements, and non controlling interests preserve insider economics while transferring complexity to public shareholders.

Revenue appears robust. Cash flow is not fully theirs. Governance influence is minimal.

This is not a judgment on the business. It is a reminder that in public private hybrids, the deal terms are the asset.

Understanding who receives the marginal dollar matters more than headline multiples.

Investor Signal

As private market structures migrate into public wrappers, return outcomes hinge on cash flow priority, not reported growth.

Rising Energy Costs Expose the Consumer Facing Edge of Infrastructure Strain

Household heating costs are set to rise materially this winter, driven by electricity demand, data center load, and natural gas volatility.

For higher income households this is noise. For marginal consumers it is pressure.

This is the retail facing expression of a broader energy constraint.

Infrastructure demand is rising faster than supply elasticity. Costs are being absorbed unevenly across regions and income brackets.

Energy is no longer a background input. It is a visible line item again.

Investor Signal

Energy constraints surface first at the consumer edge, then migrate upstream into policy, infrastructure investment, and capital allocation decisions.

FROM OUR PARTNERS

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

DEEP DIVE

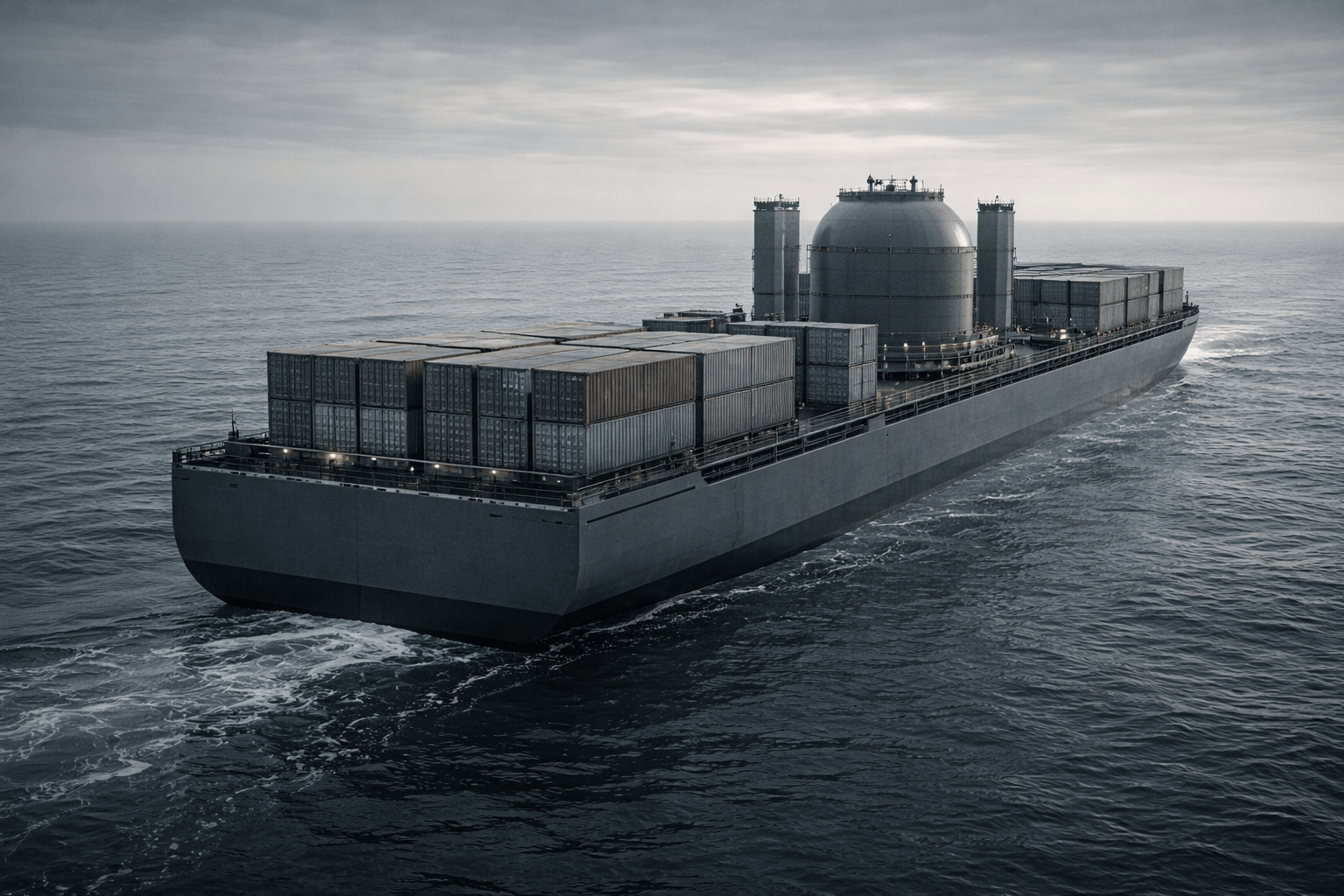

Nuclear Shipping Is a Duration Bet, Not a Technology Bet

The idea of nuclear powered commercial ships has circulated for decades without clearing economic or political thresholds. What is changing now is not enthusiasm. It is necessity.

Fuel accounts for nearly half of operating costs in global shipping. Decarbonization mandates are tightening. Alternative fuels remain scarce, volatile, or marginal in their emissions impact.

In that context, nuclear propulsion offers something rare. Cost certainty over decades.

A nuclear powered vessel can operate for roughly 25 years without refueling. Emissions are effectively zero. Exposure to fuel price shocks disappears.

The tradeoff is not subtle. Upfront costs are several times higher than conventional ships.

Regulatory frameworks do not yet exist. Port access, safety protocols, and public acceptance remain unresolved.

This is not a technology readiness problem.

It is a governance and duration problem.

New microreactors are safer, smaller, and less enriched than prior generations. MIT simulations suggest retrofitting is technically feasible and financially rational over a full vessel lifecycle.

But none of that matters without certification, diplomatic clearance, and political cover.

Nuclear shipping only works if capital is willing to commit before permission is fully formed.

That is why this is not a shipping industry story. It is a capital structure story.

The economics favor owners who can absorb high upfront costs, tolerate regulatory delay, and operate through long approval cycles without needing interim exits.

Private equity models optimized for five to seven year hold periods struggle here. Debt financing becomes complex. Exit visibility is limited.

The natural sponsors are sovereign capital, strategic operators, and balance sheets that prioritize lifetime economics over IRR optics.

The same logic now applies across infrastructure adjacent assets. Data centers. Energy systems. Grid scale projects.

When assets clear on durability rather than speed, the cost of impatience rises.

Nuclear shipping is not imminent.

But it is instructive.

It shows where markets are heading when regulation, energy costs, and decarbonization collide. The winning structures are not those with the best technology. They are those that can wait.

Investor Signal

Long duration assets are clearing only for capital that can underwrite delay, regulation, and political risk simultaneously. The barrier to entry is no longer innovation. It is endurance.

FROM OUR PARTNERS

#1 Memecoin to Own Right Now

Two of our top analysts have done the impossible — they’ve consistently spotted memecoins before they exploded.

I’m talking gains like 8,200%... 4,915%... and 3,110%, all triggered by a proven system that’s delivered 20+ big wins.

Now they’ve uncovered a brand-new memecoin showing the same explosive signals — and it could be next.

That’s why we’re revealing the #1 Memecoin to Own Right Now (time-sensitive).

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

THE PLAYBOOK

First, favor ownership structures that benefit from long lived cost certainty rather than short term optimization.

Second, treat regulatory frameworks as capital inputs, not exogenous risks.

Third, discount strategies that require precise exit timing to validate returns.

Finally, expect more assets to reprice based on who can hold them, not who can build them.

This is not a slowdown cycle.

It is a patience cycle.

Markets still reward ambition.

They now penalize urgency.