How private capital is holding shocks public markets won’t

MARKET PULSE

Private markets are absorbing forces that public pricing has largely sidelined.

Real assets are becoming proxies for technology cycles.

Healthcare scale is compressing margins faster than demand expands.

Energy enforcement is turning logistics into geopolitical risk.

China’s model is exporting pressure rather than resolving it domestically. Across sectors, duration is extending, concentration is rising, and clearing is being delayed rather than avoided.

The risk is not visible through defaults or demand. It’s embedded in structure, execution, and how long capital is willing to wait.

PREMIER FEATURE

Robotics Stocks to Watch for the Next Tech Wave

Robotics is shifting from concept to real-world growth.

Defense spending is driving demand for autonomous systems… healthcare robotics is expanding fast… and retailers are rapidly automating warehouses. The result: a robotics market now topping $200B and accelerating.

Our FREE report reveals 3 robotics stocks leading this surge—companies earning analyst upgrades, attracting institutional capital, and positioned to ride the next leg of this megatrend.

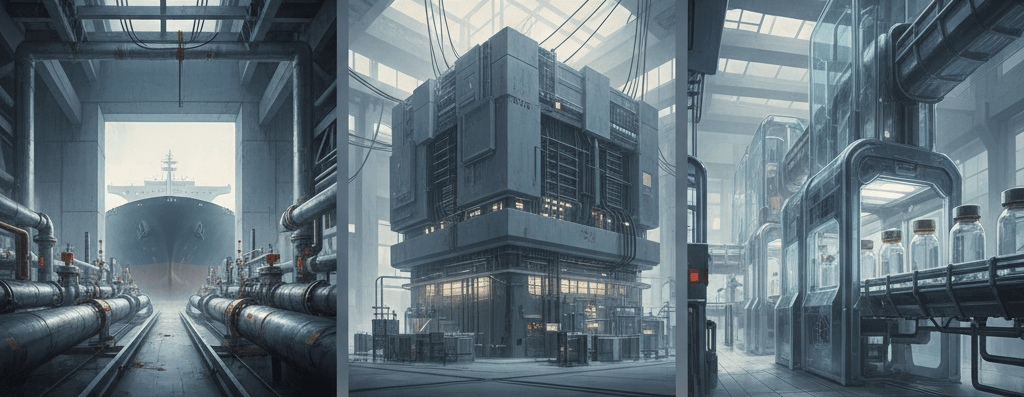

QUICK BRIEFS: REAL ASSETS AS TECH | SCALE TESTS MARGINS | ENERGY ENFORCEMENT

When Real Estate Started Trading Like Compute Capacity

Real estate is no longer pricing vacancy. It is pricing compute demand.

Long leases and institutional capital give the appearance of stability, but the risk profile has shifted.

These are no longer diversified properties. They are concentrated bets on hyperscaler demand, power availability, and construction precision.

Cash flow depends less on rent per square foot and more on whether electricity clears, timelines hold, and AI workloads keep scaling.

A 20-year lease only protects returns if the tenant’s compute needs persist and the facility delivers exactly as promised. Miss a power commitment or a delivery window, and the downside accelerates fast.

What looks like defensive yield is closer to infrastructure leverage. Real assets are now expressing technology-cycle risk, not smoothing it. Diversification disappears when one tenant class dominates demand.

Real estate didn’t just change tenants. It changed what it’s exposed to.

Investor Signal

Data centers are no longer passive yield. As real assets become compute derivatives, concentration and execution risk will matter more than lease length.

Novo Nordisk First Out Of The Gate With Oral Weight-Loss Drug

The breakthrough wasn’t efficacy. It was access.

Pills are cheaper, easier to distribute, and far more compatible with insurance coverage and telehealth funnels.

That expands the addressable market fast, but it also rewires pricing power.

Lower monthly pricing pulls volume forward while compressing unit economics. Manufacturing scale, reimbursement leverage, and cadence now matter more than first-to-market optics.

The competitive edge shifts from clinical superiority to who can supply reliably, negotiate coverage, and defend margins as pills normalize weight-loss treatment.

What looked like a demand unlock is also a discipline test. Wider access invites faster competition, tighter pricing scrutiny, and less tolerance for inefficiency.

Growth remains real, but margins are now the clearing mechanism.

Investor Signal

GLP-1s are entering a scale phase, not a scarcity phase. As distribution widens, execution and cost control will separate durable winners from early leaders.

Oil Enforcement Went Physical, and China Felt It

A tanker seizure is no longer a footnote. It’s the message.

The U.S. has moved from paper sanctions to physical interdiction, seizing vessels tied to Venezuela’s shadow oil trade using maritime boarding agreements and flag-state leverage. The immediate target isn’t supply volume. It’s routing.

This shift pulls energy risk out of compliance departments and into shipping lanes. Freight rates, insurance premiums, delivery timing, and port access now carry geopolitical weight.

Flags, canals, and transshipment points are no longer neutral infrastructure.

They’re enforcement tools.

Markets don’t need a supply shock to reprice. Uncertainty alone widens spreads. When enforcement turns physical, volatility shows up early, long before fundamentals change.

Investor Signal

Energy risk is migrating from contracts to corridors. Physical enforcement adds a premium that doesn’t wait for volume loss. China is now the counterparty being quietly repriced.

FROM OUR PARTNERS

Everyone’s Watching Bitcoin — Smart Investors Are Scooping Up the Altcoins No One Is Touching

While the crowd panics and dumps, a smaller group of investors quietly buys bargains. The result: altcoins are trading at steep discounts — even as fundamentals begin improving in the background.

This isn’t hype. It’s a classic buy-low setup that has historically rewarded patient investors — and opportunities like this don’t come around often.

The Crypto Retirement Blueprint shows how to identify the coins with the potential for outsized gains — even if you start small.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

DEEP DIVE

China Built the Technology. The Economy Didn’t Follow.

China has solved the technology problem without solving the economy.

even as property prices slide, consumption weakens, and local governments strain under debt.

Those two realities coexist because they are no longer required to align. Innovation is being financed as a security asset, not as an extension of household demand or economic comfort.

State-directed capital is doing what it was designed to do. R&D spending surged nearly 50% in four years.

Redundancy, overcapacity, and loss-making firms are tolerated because resilience against sanctions and export controls matters more than efficiency. Capital waste is not a bug. It is insurance.

The cost shows up elsewhere. Job creation lags. Consumption stalls. Local governments fund robotics parks while delaying wages.

Productivity growth slows even as factories automate at scale. This is not a temporary imbalance. It is a structural tradeoff.

When domestic demand weakens, the system leans outward.

Exports become the release valve. That dynamic hardens global trade friction, forces competitors into defensive policy, and keeps supply chains under constant pressure.

China’s record trade surplus is not a sign of economic health. It is a substitute for it.

For private markets, the implication is durability risk. Technological momentum is unlikely to stall. Economic fragility increases the probability that external pressure, trade disputes, and strategic escalation are used to sustain the model.

The system can produce frontier capability without fixing household balance sheets, but it cannot do so quietly.

This is not a growth story losing steam. It is a security-driven model decoupling technology from consumer welfare. The tension does not resolve internally. It exports itself.

Investor Signal

China’s technological trajectory is not constrained by domestic weakness. The risk lies in how economic fragility raises the odds of outward pressure as a stabilizer. Private capital must price geopolitical durability alongside innovation strength.

FROM OUR PARTNERS

AI's NEXT Magnificent Seven

The Original Magnificent Seven Produced 16,894% Average Returns Over 20 Years.

But the Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

THE PLAYBOOK

Risk is migrating away from prices and into structures. Concentration is replacing diversification across real assets.

Scale is expanding access while tightening margin discipline.

Geopolitics is entering logistics, not just contracts.

State-backed models are prioritizing endurance over efficiency.

The next repricing won’t be sudden… it will surface when execution or patience breaks.