FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

After a week that repriced clearance and structure, the next data and earnings will reveal how much financing tolerance remains

MARKET PULSE

Last week did not change the market’s direction.

It changed the market’s conditions.

Capital did not retreat. It became conditional.

Across private markets, the repricing showed up first in permission, liquidity behavior, refinancing confidence, and exit math rather than in marks or defaults.

That framing matters for the week ahead.

The next set of data releases and earnings will not be judged on whether growth still exists. Growth clearly does.

They will be judged on whether financing assumptions can still hold under tighter clearance standards.

Labor, inflation, and earnings will all be read through the same lens:

Can capital still move on schedule, refinance cleanly, and exit without renegotiation?

Public markets may debate soft landings and rate timing.

Private markets will quietly answer a different question: how much time they are still willing to underwrite.

PREMIER FEATURE

Your Portfolio May Be Missing the Next Magnificent Seven

If you own none of the next generation of AI leaders, your portfolio could be more exposed than you realize.

The original Magnificent Seven turned $7,000 into $1.18 million.

But according to one veteran investor, the next seven could play out far faster — potentially in six years, not twenty.

Why?

Because AI adoption is accelerating at a pace we’ve never seen before.

Now, the analyst who identified Nvidia back in 2005 is revealing the seven AI stocks he believes are positioned to lead the next wave — free for a limited time.

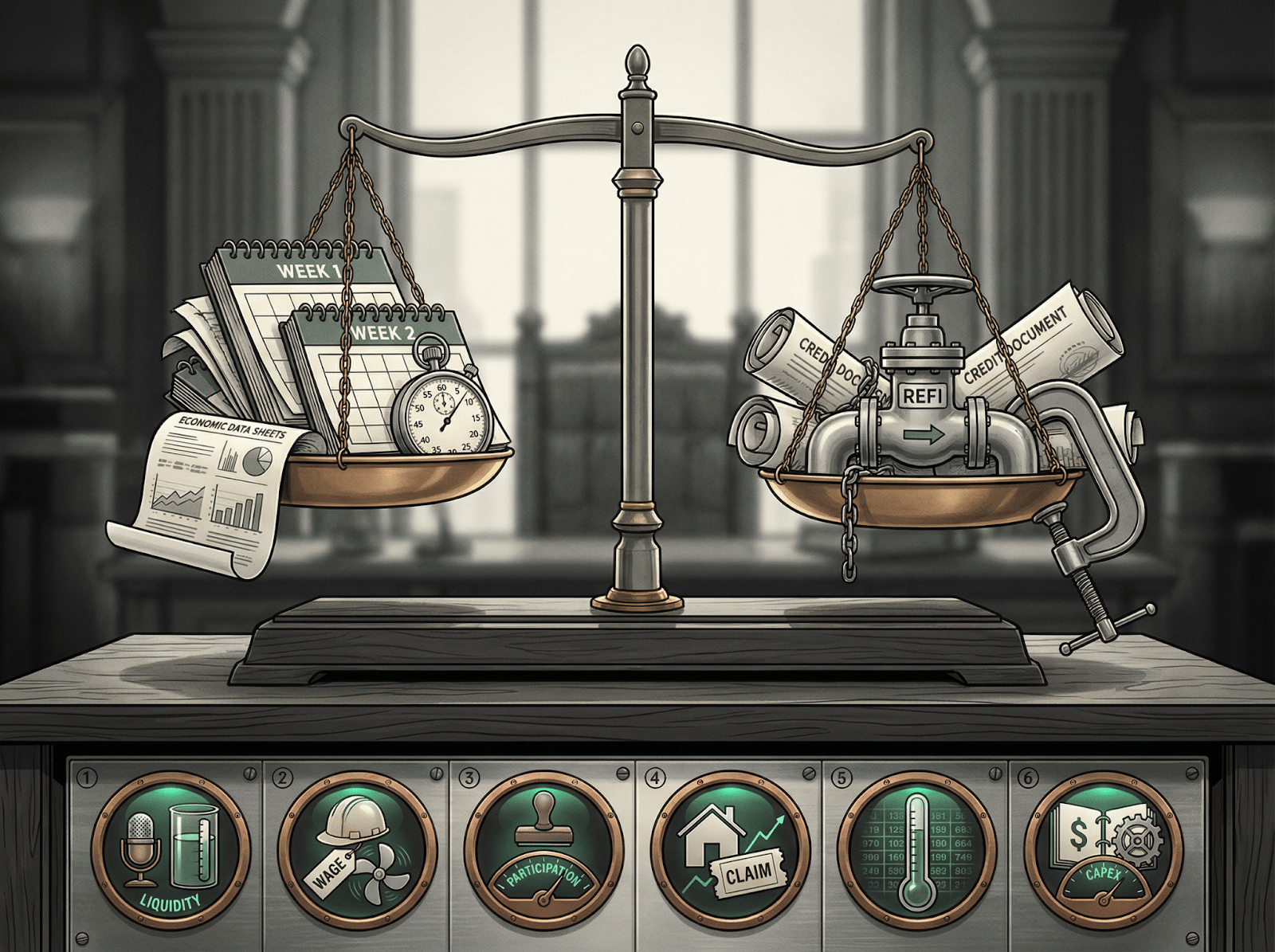

THE WEEK AHEAD IN SIX PRESSURE POINTS

PRESSURE POINT 1

Fed speakers test whether liquidity assumptions stay intact

The coming week is heavy with Federal Reserve speakers including Christopher Waller, Adriana Kugler Miran, Raphael Bostic, Beth Hammack, Lorie Logan, and Michelle Bowman.

This is not about tone or rhetoric.

It is about balance sheet expectations and liquidity regime risk.

Last week reintroduced the idea that balance sheet policy is no longer dormant. Markets reacted immediately when the possibility of tighter reserve management reentered the discussion.

Yields moved. The dollar firmed. Metals sold off. That reaction matters because private credit depends on predictable funding conditions even more than on policy rates.

If speakers lean toward patience and balance sheet stability, refinancing tolerance can hold.

If balance sheet ambiguity grows, lenders shorten duration and widen terms even if rates stay unchanged.

PMD Investor Signal

Treat Fed communication as a funding stability input, not a rate signal. Any renewed uncertainty around reserves or liquidity mechanics tightens private credit tolerance before spreads visibly move.

PRESSURE POINT 2

Tuesday decides whether labor is cooling cleanly or fragmenting

Tuesday’s data slate includes ADP Employment Change, Retail Sales, the Employment Cost Index, Export and Import Prices, and Business Inventories.

The combination matters more than any single print.

ADP will be read less for headline job creation and more for direction. A gradual slowdown without a collapse supports refinancing confidence. A sharp deceleration introduces timing risk.

The Employment Cost Index is the most important input for private markets.

Wage pressure that remains elevated keeps financing costs sticky and compresses margin recovery assumptions for labor intensive businesses.

Retail sales and inventories together will reveal whether demand is holding without excess stock buildup. Stability here supports exit windows.

Inventory accumulation without sales growth reintroduces balance sheet risk.

PMD Investor Signal

If wage growth remains firm while hiring slows, assume tighter leverage tolerance and more conservative add backs for consumer and services exposures. If labor cools cleanly, selective refinancing windows reopen but only for assets with proven cash conversion.

FROM OUR PARTNERS

Smart Money Is Accumulating This Altcoin for the Trump Bull Run

The market is down and fear is everywhere — but big institutions aren’t slowing down.

BlackRock is buying. Fidelity is building. Major players are still positioning for what’s coming next.

Behind the scenes, insiders are quietly loading up on one altcoin playing a critical role in a fast-growing crypto ecosystem — similar to early Uniswap before it took off.

With Trump’s pro-crypto policies beginning to take effect and a bull run approaching, this coin could be set up for major upside.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

PRESSURE POINT 3

Wednesday is the labor regime verdict

Wednesday’s Non Farm Payrolls, Unemployment Rate, and Labor Force Participation Rate form the hinge of the week.

For private markets, the mix matters more than the headline.

Payroll growth without participation gains keeps labor scarce and wages elevated. That scenario preserves demand but tightens financing tolerance.

A softer payroll number paired with rising participation signals normalization, but it also implies demand may be cooling in the very sectors portfolio companies depend on.

Neither outcome is bearish. Both are conditional.

PMD Investor Signal

Underwrite labor outcomes as timing variables. Strong payrolls keep financing costs high. Weak payrolls lengthen diligence and delay exits. In both cases, duration remains priced.

PRESSURE POINT 4

Thursday checks credit stress before earnings do

Initial Jobless Claims and Existing Home Sales arrive Thursday.

Claims are not a recession signal. They are a lender behavior signal.

A steady drift higher tightens underwriting quietly even when earnings remain intact.

Housing data will be read through the same clearance lens. Transactions matter more than prices. Liquidity matters more than affordability narratives.

Residential and commercial real estate financing continues to sort by balance sheet strength rather than asset quality alone.

PMD Investor Signal

Rising claims pull leverage capacity down before marks adjust. Expect tighter borrowing base treatment and slower refinancing timelines in employment sensitive sectors.

FROM OUR PARTNERS

A former hedge fund insider just unveiled money-making codes

Larry Benedict ran a top 1% fund and made $274 million in profits.

Now, he's sharing the money-making codes they used…

You can punch these codes into an ordinary brokerage account and potentially "skim" $6,361 or more today.

PRESSURE POINT 5

Friday’s inflation prints decide whether time stays expensive

Friday’s CPI, inflation rate, and core inflation rate will not be judged on surprise magnitude. They will be judged on persistence.

Sticky services inflation keeps financing costs heavy and reinforces last week’s theme: time is no longer free. Even modest inflation persistence keeps lenders conservative.

A clean downside surprise does not immediately loosen private financing. It simply prevents further tightening.

PMD Investor Signal

Do not underwrite rate relief as a catalyst. Inflation that merely stabilizes keeps duration expensive. Financing tolerance improves only when confidence around cash conversion improves alongside inflation relief.

PRESSURE POINT 6

Earnings will show where structure still clears

This is a dense earnings week, and the names matter because they anchor financing assumptions across sectors.

Private capital and financial infrastructure will look to Apollo Global Management, S&P Global, and AIG for signals on credit appetite, pricing power, and risk transfer behavior.

Healthcare earnings from Becton Dickinson, Gilead Sciences, Edwards Lifesciences, Vertex Pharmaceuticals, Moderna, Alnylam Pharmaceuticals, and Zoetis will be parsed for pricing pressure, reimbursement friction, and margin durability under policy influence.

Consumer and services names including Coca-Cola, McDonald’s, Marriott, Hilton, Airbnb, CVS Health, and Ford will show whether pricing holds without promotion creep and whether volume remains resilient.

Technology and infrastructure exposure from Datadog, Applied Materials, Arista Networks, Motorola Solutions, Equinix, T-Mobile, Coinbase, AppLovin, and ANET will be judged on cash conversion, capital intensity, and customer payment behavior rather than growth narratives.

Utilities and real assets through Duke Energy, American Electric Power, Exelon, Entergy, Public Storage, Welltower, CBRE, and Xylem will provide a read on regulated returns, power demand, and refinancing tolerance.

PMD Investor Signal

Treat guidance as underwriting commentary. Where management emphasizes financing, counterparty behavior, or capital allocation discipline, clearance is tightening. Where cash conversion is explicit, financing tolerance holds.

FROM OUR PARTNERS

Before the AI Wealth Gap Widens, See This List

Blue-chip stability meets AI growth in The 10 Best AI Stocks to Own in 2026.

Inside: a top-10 dividend payer rolling out AI-powered logistics across 200 countries… a $300B titan embedding AI across its full product stack… and a semiconductor leader still trading 15% below its 52-week high.

All proven operators, all using AI to widen their lead.

See the list for free today, after that, you’ll have to pay.

PMD REPOSITION

The coming week will not decide whether the economy slows or accelerates.

It will decide whether financing tolerance tightens further or simply holds.

If labor cools without a wage shock and inflation stabilizes, selective refinancing and exit windows can reopen.

If wages stay firm or liquidity confidence erodes, capital will continue filtering winners by structure, not story.

The evidence will not arrive through marks or defaults.

It will arrive through terms, timelines, and which deals still clear without negotiation.

PMD remains focused on identifying those pressure points before the repricing becomes visible.