AI power demand, tightening consumer behavior, and capital-heavy platforms are all pointing to the same shift. Returns are no longer priced on speed. They are priced on endurance.

MARKET PULSE

Markets Still Trade Liquidity. Projects Trade Reality.

Public markets remain calm.

Equities are firm. Credit spreads are contained. Capital is still available.

But the friction is building elsewhere.

Across private markets and capital-intensive sectors, the constraint is no longer access to capital.

It is the ability to deploy it without requiring precise timing to make the economics work.

Power is scarce.

Fixed costs are sticky.

Exit timelines are stretching.

This is not a retreat from growth.

It is a repricing of what kind of growth clears.

Capital is migrating toward assets that convert long holding periods into stability rather than risk.

Infrastructure-like revenues.

Distribution platforms.

Systems that function even when timelines slip.

Liquidity still exists.

Optionality is thinning.

PREMIER FEATURE

The Crypto Forecast I Wasn’t Supposed to Share

The Crypto Forecast I Wasn’t Supposed to Share

For years, I’ve interviewed billionaire founders, hedge fund managers, and early Bitcoin insiders.

But recently, behind closed doors, they all started preparing for the same thing — an event they believe could trigger the biggest wealth transfer in crypto history.

After 600 insider interviews and 17 million podcast downloads, I finally connected the dots and revealed everything in my new book Crypto Revolution — now FREE.

Inside, you’ll see:

• Why insiders believe Bitcoin could reach $300,000

• The hidden accumulation pattern forming right now

• And the “point of no return” most people won’t see coming

Once this goes mainstream, the early edge disappears.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

QUICK BRIEFS

OpenAI Faces a Make-or-Break Year in 2026

OpenAI enters 2026 with extraordinary scale and equally extraordinary burn.

Revenue growth has been historic.

So have computing costs.

Demand for its models continues to rise, but inference and training expenses remain tightly coupled to usage.

Each marginal user still carries meaningful cost. Free access amplifies the imbalance.

This is not a relevance problem.

It is an infrastructure economics problem.

Compute behaves like a utility input, but OpenAI does not yet price it like one. As competition intensifies and model performance converges, the burden shifts from innovation to operating leverage.

Investor Signal

When growth scales capital intensity one-for-one, duration stops being an advantage. It becomes the risk investors start underwriting.

Restaurants Close Locations as Fixed Costs Bite

Restaurant chains accelerated closures in 2025.

Not because demand vanished, but because the economics stopped clearing.

In that environment, square footage becomes stranded capital. Operators are choosing contraction over coverage to protect cash flow and relevance.

This is not failure.

It is rational consolidation.

The same pattern is visible across private markets. When flexibility disappears, capital concentrates around what can endure rather than what can scale quickly.

Investor Signal

When operating leverage turns negative, scale becomes a liability. Tighter systems win.

Housing Affordability Improves, But Entry Remains Gated

Mortgage rates are lower.

Prices have flattened.

Monthly affordability is improving. Participation is not.

The bottleneck is no longer the payment.

It is the down payment.

Access capital remains the gate to ownership. Entry depends more on balance-sheet strength than on confidence in future prices.

Housing is echoing a broader private-market signal. Liquidity conditions can improve while access remains constrained.

Investor Signal

When upfront capital determines participation, incumbents gain leverage and entry slows.

FROM OUR PARTNERS

Trump's Next Export Ban Could Reshape the Global Economy

It's not semiconductors, AI chips or quantum computers. But none of those technologies can exist without it.

On January 19th, 2026, Trump is expected to ban exports of something every tech company desperately needs—forcing them all to relocate to U.S. soil.

DEEP DIVE

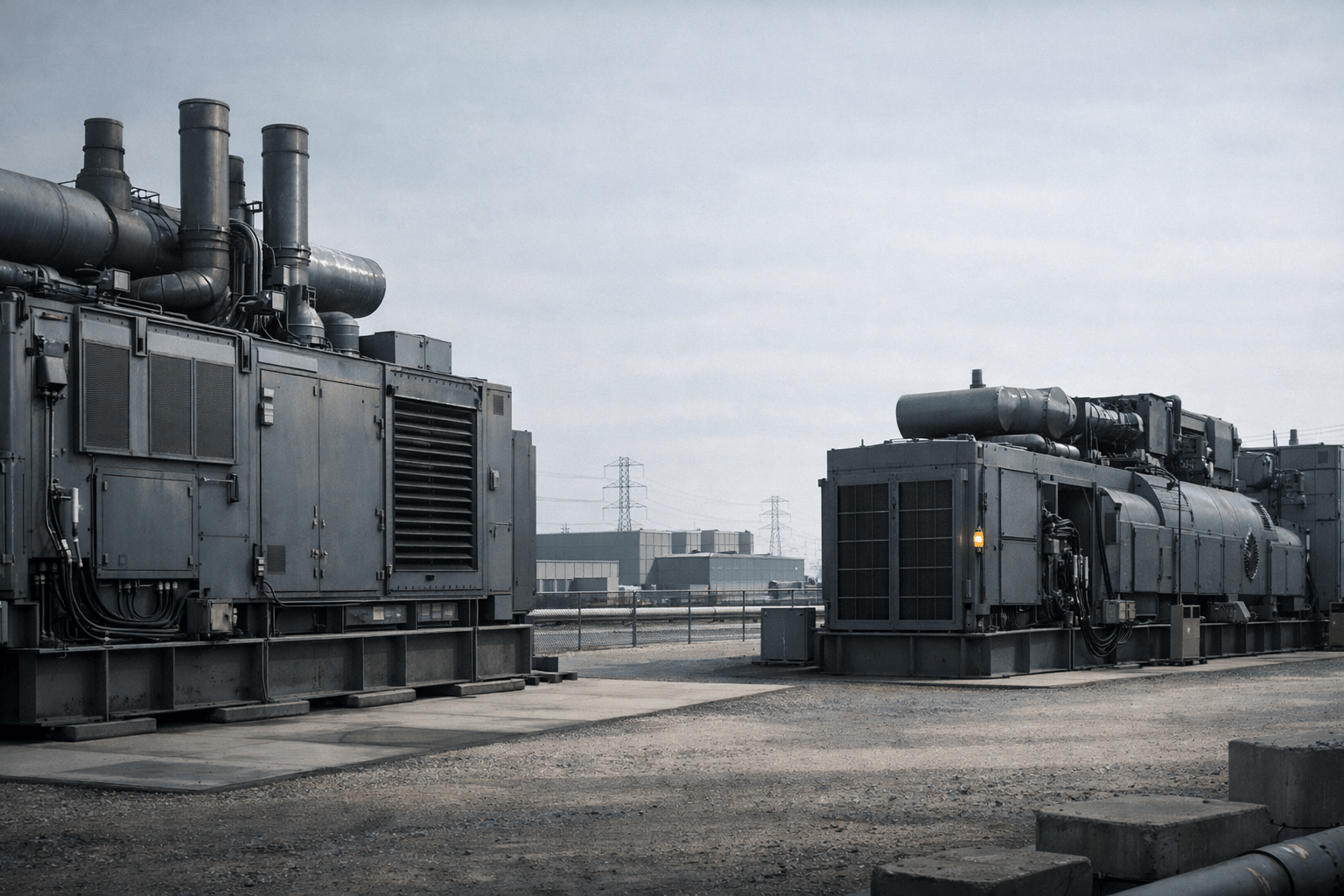

Caterpillar’s AI Boom Is a Power Story, Not a Construction Story

Caterpillar’s stock surge is not being driven by excavators.

It is being driven by generators.

The company’s power and energy segment has become its fastest-growing business, fueled by data-center developers who cannot rely on the grid to meet AI-driven demand.

Electricity is constrained.

Permitting is slow.

Grid reliability is uneven.

Developers are responding by internalizing the problem. They are building power on site.

That shift changes the economics entirely. Generators are no longer backup equipment. They are core infrastructure.

For Caterpillar, this means long-dated orders, service-heavy relationships, and revenue tied to projects with multi-decade horizons.

These are not cyclical sales tied to construction starts. They are commitments embedded in permanent systems.

Customers are no longer trading around uncertainty.

They are designing around it.

That logic mirrors what’s happening elsewhere.

OpenAI is discovering that scale without infrastructure pricing creates stress.

Restaurants are shrinking footprints to realign fixed costs with durable demand.

Housing shows that access capital, not sentiment, sets participation.

Across markets, optionality is losing value.

Endurance is gaining it.

Investor Signal

Infrastructure wins when it converts constraint into certainty. Assets that secure critical inputs and bypass bottlenecks gain leverage as duration becomes scarce.

FROM OUR PARTNERS

Your Portfolio May Be Missing the Next Magnificent Seven

If you own none of the next generation of AI leaders, your portfolio could be more exposed than you realize.

The original Magnificent Seven turned $7,000 into $1.18 million.

But according to one veteran investor, the next seven could play out far faster — potentially in six years, not twenty.

Why?

Because AI adoption is accelerating at a pace we’ve never seen before.

Now, the analyst who identified Nvidia back in 2005 is revealing the seven AI stocks he believes are positioned to lead the next wave — free for a limited time.

THE PLAYBOOK

This cycle rewards capital built to wait.

First, favor assets that control critical inputs rather than rely on shared systems. Power, access, and distribution matter more than theoretical demand.

Second, scrutinize capital intensity as closely as growth. Scale without cost decoupling amplifies risk.

Third, expect consolidation where fixed costs overwhelm flexibility. Shrinking footprints are a feature, not a bug.

Finally, recognize that access capital is becoming the gate across sectors. Participation increasingly belongs to balance sheets that can commit early and hold.

Private markets are not freezing.

They are reorganizing.

The edge is shifting toward assets that turn permanence into leverage and constraint into stability.