FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

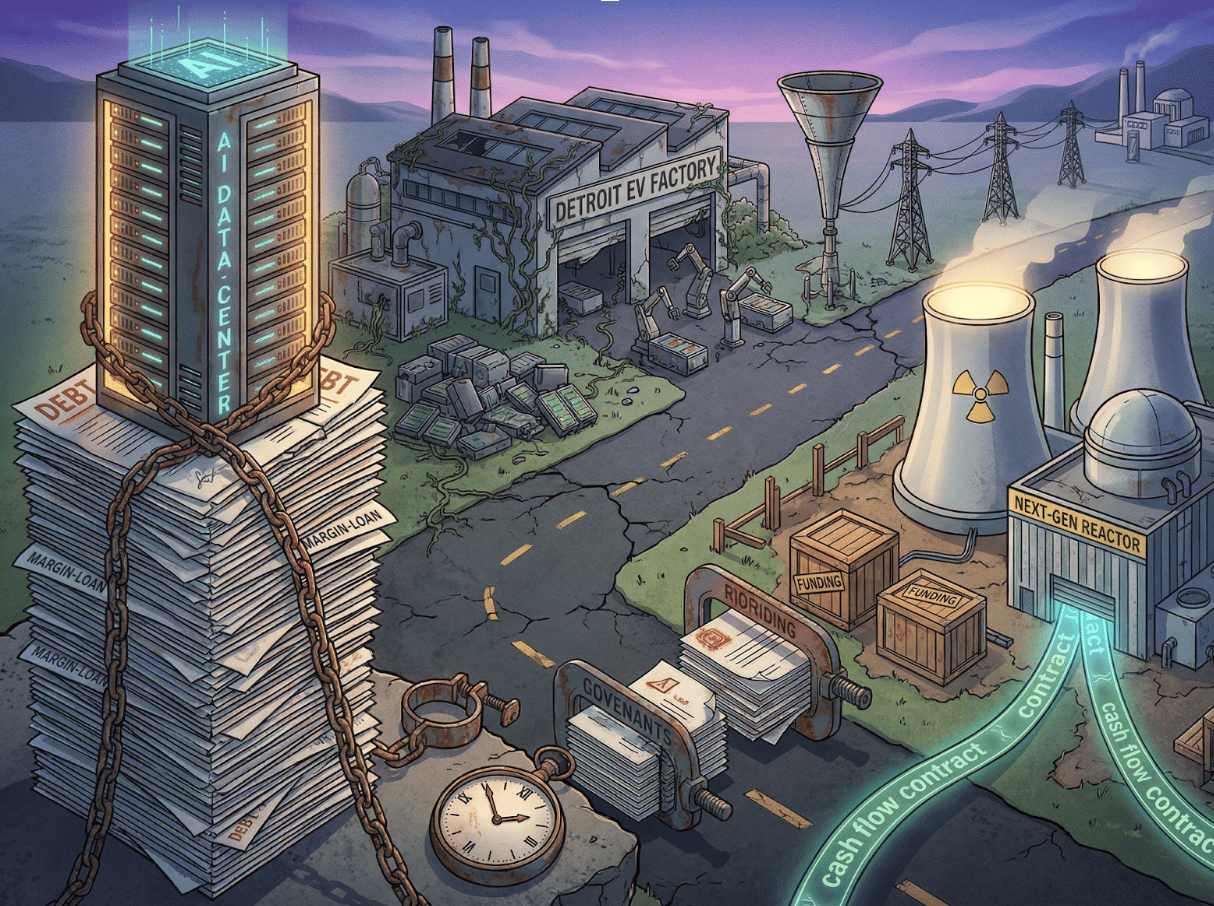

SoftBank is layering debt onto its OpenAI exposure. Detroit is writing down EV overbuild. Nuclear funding is accelerating. Infrastructure capital is rotating toward durability. The common thread is duration being financed before economics are fully proven.

THE SETUP

Markets look composed. AI demand is strong. Credit remains available. Infrastructure deals are clearing.

But capital is starting to bifurcate.

On one side, leverage is being layered onto concentrated AI exposure. On another, billions in EV capacity are being written down after policy and demand curves failed to clear.

Meanwhile, infrastructure funds are doubling down on politically strategic power assets, and nuclear startups are raising capital at scales that assume inevitability.

This is not a growth scare.

It is a duration test.

Capital is still being deployed aggressively. The question is whether it is being deployed against durable cash flow or against assumptions about future inevitability.

When longevity gets financed before economics are proven, the unwind shows up in different places: write-downs, refinancing stress, margin calls, or consolidation.

PMD Lens

Private markets do not reprice when growth slows. They reprice when duration assumptions break.

Layered leverage against a single private AI exposure is a duration bet. EV overbuild was a duration bet. Early-stage nuclear infrastructure is a duration bet.

Infrastructure continuation funds are a bet on cash flow that already exists.

The difference is not sector. It is whether cash flow is present and defensible today, or projected and reflexively financed tomorrow.

When permanence is funded before proof, leverage becomes the pressure point. When durability is anchored to contracted demand and political relevance, capital becomes patient.

WHAT MOST PEOPLE WILL MISS

Leverage layered onto private AI exposure compounds valuation reflexivity

Physical asset write-downs are duration errors, not just demand misses

Infrastructure capital is consolidating around politically durable cash flow

Early-stage energy funding is scaling before cost curves are proven

The unwind of duration rarely hits revenue first. It hits capital structure

PREMIER FEATURE

Fast Movers or Steady Earners? Nuclear Has Both

AI isn’t a tech trend – it’s a full-blown, multi-trillion dollar race. And these 10 companies are already pulling ahead.

One dominates AI hardware with a full-stack platform and rising analyst targets.

Another ships accelerators to major hyperscalers with ~28% revenue growth ahead.

Get those tickers and 7 more in The 10 Best AI Stocks to Own in 2026 for free today

SIGNALS IN MOTION

The signals below are not forecasts. They are mechanisms already in motion. Each one reveals the same pattern: duration is being financed before economics are fully proven.

Detroit Automakers Take $50 Billion Hit as EV Bubble Bursts

Detroit automakers are taking major write-downs following EV demand slowdown and policy retrenchment. This is duration misallocation in physical form.

Capacity was built under regulatory certainty and projected demand curves that did not clear. Subsidies faded. Pricing softened. Write-downs crystallized the gap between installed capacity and actual cash flow.

This is not about EV ideology. It is about capital intensity meeting unstable assumptions.

Physical assets cannot pivot as quickly as narratives do.

The lesson extends beyond automotive. Any sector building capacity ahead of proven demand faces the same test.

When policy support becomes the primary underwriting assumption rather than market demand, duration risk enters the capital structure disguised as strategic positioning.

Investor Signal

What looked like strategic positioning was duration risk. When policy support and demand momentum weakened, write-downs followed. Physical overbuild is the industrial version of financial overleverage.

Investment Firms Strike $3.4 Billion Deal for Peruvian Power Producer

A continuation fund structure is being deployed for strategic infrastructure. This is the counterpoint. Capital is not retreating. It is rotating toward assets with visible demand and geopolitical relevance.

Power generation in a strategically contested region carries real load, real cash flow, and political leverage.

Continuation fund mechanics matter. Existing capital is choosing to extend duration where durability is defensible.

The deal structure itself signals confidence. When LPs allow GPs to roll positions into continuation vehicles rather than forcing exits, it reflects conviction that cash flows will remain stable and strategic value will compound.

This is the opposite of reflexive financing. It is patient capital backing proven assets.

Investor Signal

When narrative duration wobbles, capital migrates toward contracted infrastructure with political relevance. Durability, not acceleration, is attracting scale capital.

FROM OUR PARTNERS

Crypto Is Still Minting Millionaires, Here’s How

Over the last decade, crypto has created hundreds of thousands of new millionaires and the biggest wealth opportunities aren’t over yet.

But most investors lose money chasing random coins instead of following a proven plan.

A new Crypto Retirement Blueprint reveals a step-by-step strategy to help position for massive crypto gains before the crowd catches on.

For a limited time, it’s available for an unbelievable 97% discount.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Next-Gen Nuclear Funding Looks Livelier Than Ever

Large Series A raises and multibillion commitments are flowing into next-generation nuclear. The technology deserves serious treatment. But the sequencing risk is real.

Capital is underwriting infrastructure before commercial economics are proven at scale. Pilot projects require massive upfront investment.

Public market receptivity remains open. This mirrors early EV and renewable buildout phases where capital scaled ahead of proof.

The parallels to earlier infrastructure buildouts are instructive. Solar and wind received similar early-stage enthusiasm.

Capital flowed before cost curves proved out. Some bets paid off handsomely. Others did not.

The difference came down to who controlled the proven economics versus who financed the promise.

Investor Signal

Early capital does not guarantee economic inevitability. When infrastructure funding accelerates ahead of proven cost curves, duration risk accumulates quietly inside the capital stack.

DEEP DIVE

SoftBank Loads Up On Debt to Pay for OpenAI Bet

This is not a tech story. It is a capital structure story.

SoftBank is layering leverage onto a concentrated private AI exposure. Margin loans against Arm. Debt issuance that understates total leverage optics.

Financial engineering layered on top of a valuation cycle that depends on continued strength in AI enthusiasm.

This creates reflexivity. Public equity strength supports borrowing capacity. Borrowing capacity supports continued exposure. Exposure reinforces narrative strength.

The risk is sequencing. If valuation momentum slows before liquidity opens, leverage remains while exit optionality narrows.

Margin loans do not wait for long-term theses to play out. They operate on shorter timeframes than fundamental value realization.

The structural tension is clear: AI permanence is being financed with layered leverage before it has been tested across a full cycle.

Valuation supports collateral. Collateral supports leverage. Leverage reinforces valuation.

When these dependencies stack, small moves get amplified. A modest valuation reset becomes a liquidity event.

A liquidity event becomes a forced unwind. The system works beautifully in one direction. It compounds quickly in the other.

No headlines announce that underwriting standards are tightening. But deal structures change. Exit timelines extend.

Covenant packages get more defensive. The market is not panicking. It is simply demanding more proof before committing to longer holding periods.

Investor Signal

The mispriced risk is capital structure reflexivity. Layered leverage tied to a single private AI asset magnifies duration exposure. If valuation resets before monetization, liquidity pressure arrives before fundamentals resolve.

FROM OUR PARTNERS

End of America: The Countdown To $40 Trillion

As the national debt hurtles towards $40 trillion, the analyst behind world-famous documentary End of America returns with a new warning:

“Gold Is Money Again”

THE PLAYBOOK

Stress test duration assumptions before underwriting growth narratives

Separate durable cash flow from projected inevitability

Model leverage outcomes under delayed liquidity, not just continued expansion

Treat policy-anchored demand curves as reversible inputs

Prioritize assets with contracted demand and geopolitical relevance

Be skeptical of infrastructure capital stacks that scale ahead of proven economics

Assume valuation momentum can reverse faster than leverage can unwind

THE PMD REPOSITION

Private markets are not retreating from risk. They are dividing between financed permanence and funded durability.

SoftBank shows financial duration being levered. Detroit shows physical duration being written down. Peru shows capital consolidating around strategic cash flow. Nuclear shows early-cycle infrastructure scaling before proof.

The question is not whether growth continues.

It is whether your exposure depends on narrative duration or on enforceable cash flow.

In this phase, duration is the spread.