FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

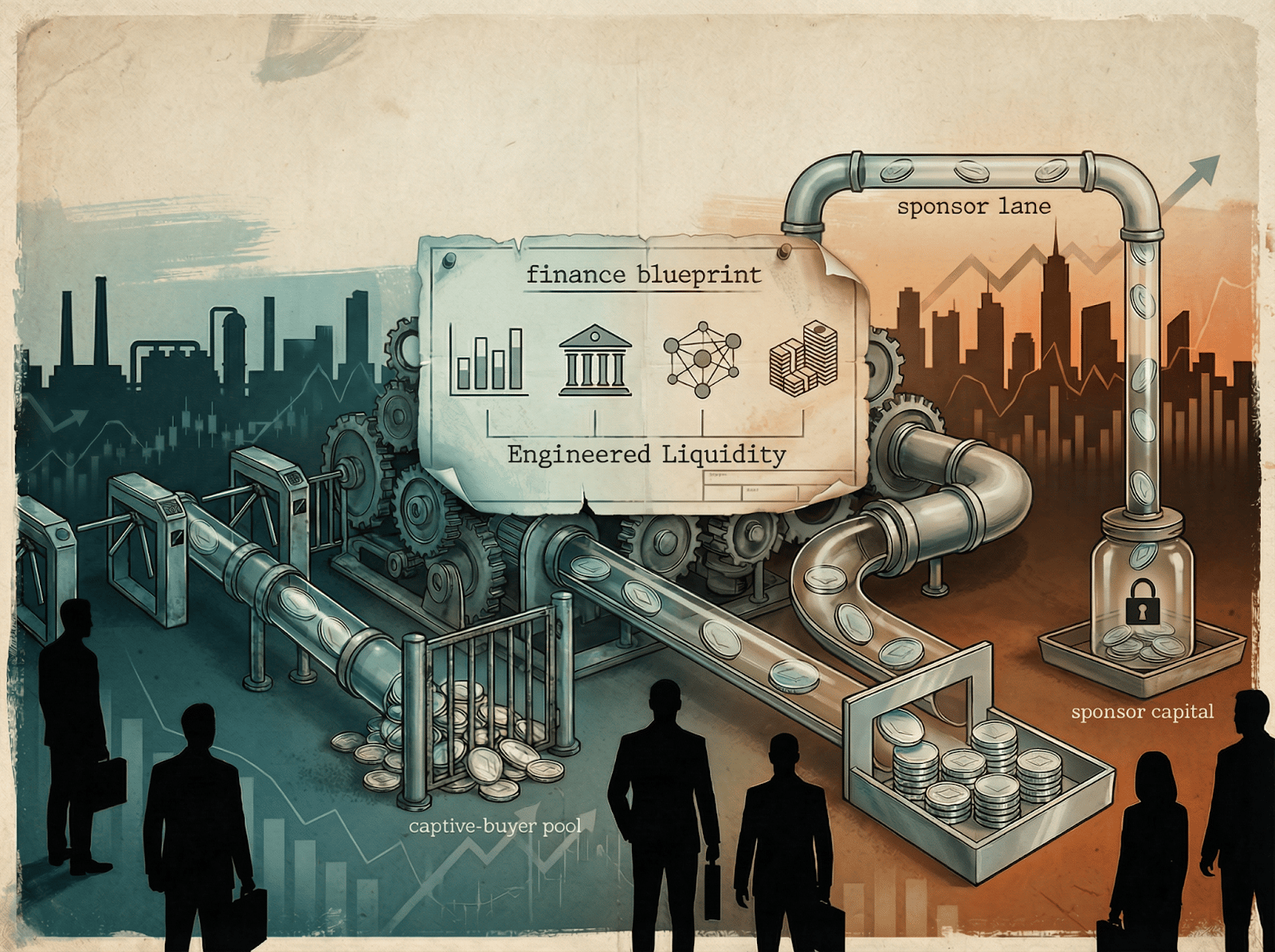

Index rules, government money, major platforms, and private funds are changing how exits happen. Liquidity is no longer something markets create naturally. It's now built in advance by those who control access.

THE SETUP

The question is not whether your assets are strong. It's whether you can actually exit when you need to.

Public markets still decide prices. But private markets are now deciding who gets to exit and when. The biggest moves this week are not about earnings or valuations. They're about who writes the rules and who controls the channels.

When exits can be pre-arranged, markets become the final step instead of the first one. This shift is visible in three ways.

Index inclusion is being used to guarantee demand. Government investors are backing projects before markets can judge them. Platforms control which startups get funding. Large sponsors are building their own exit systems.

PMD Lens

Private markets don't react to news. They react to who controls the gates.

When exits can be designed through rules and relationships, investors care less about growth potential and more about exit certainty. Controlling access becomes valuable collateral. This isn't market stress. It's deliberate design.

Liquidity hasn't disappeared. It's been moved. Instead of open markets deciding, a small group of large players now creates pre-approved paths that reduce risk for themselves.

WHAT MOST PEOPLE WILL MISS

Index rules now function as infrastructure, not neutral measurement

Government backing validates projects before market testing

Platforms decide which companies get capital access first

Private funds create exit paths that skip open markets

The real risk is being outside the approved channels

PREMIER FEATURE

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks — companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses — reliable payouts today, compounding gains tomorrow.

SIGNALS IN MOTION

Government Money Is Pre-Approving AI Infrastructure

Positron raised $230M Series B to compete with Nvidia, with government investors joining traditional venture backers. The story here isn't about chip technology. It's about who's funding it and why.

When government money backs a hardware startup, it signals something different than normal venture investing.

These projects get treated as essential infrastructure, not speculative bets. That backing removes typical financing hurdles. It tells other investors that future funding rounds and eventual exits face less uncertainty because strategic players are already committed.

Investor Signal

Strategic stacks now clear faster when they secure an anchor buyer. Sponsorship is replacing market neutrality as the determinant of funding speed and liquidity access.

Platform Power Determines Capital Access

Y Combinator was the most active fintech investor in 2025. This is not about deal volume. It is about control over which companies gain access to capital pathways.

At this scale, platform participation becomes a prerequisite for later-stage visibility.

Inclusion confers immediate credibility and accelerates follow-on funding. Exclusion raises the cost of capital and extends the path to liquidity.

Investor Signal

Capital access is now platform-mediated. Assets outside dominant channels face higher capital costs and longer liquidity timelines.

Sponsors Are Building Private Exit Systems

Prologis is creating a dedicated fund to acquire the data center assets it develops. Large sponsors are increasingly building internal liquidity systems.

Rather than relying on open markets, sponsors are embedding captive buyers within their own structures.

Assets are developed, transferred internally, and cleared without market timing risk. Public markets serve as pricing references, not clearing venues.

Investor Signal

The fastest-clearing assets are those with a captive bid. Funds are becoming liquidity factories. Markets are reduced to pricing layers.

FROM OUR PARTNERS

Trump Backed One Massively Profitable American Company

There’s a new Trump story that could change everything — and it’s not about tariffs, foreign policy, or Congress.

It’s a story most people haven’t seen in the news, on cable TV, or or anywhere else.

Trump has made a public statement about one massively profitable American company, one most people have never heard of yet.

He actively went to bat for it and considers it crucial to the U.S. economy.

Some believe this could be one of the most undervalued stocks in the entire market, with the potential to make shareholders extremely wealthy.

DEEP DIVE

How Index Rules Became Exit Strategy

SpaceX wants early index inclusion as part of its IPO plans. This matters far beyond one company going public. It shows how the relationship between private markets and public indexes is changing.

Historically, index inclusion was something that happened after a stock proved itself. Companies went public, traded for a while, met certain criteria, and then got added to major indexes.

That addition brought passive fund buying, but it was a reward for success, not a starting point.

SpaceX is attempting something different. The company wants to secure index inclusion as part of the IPO process itself. This would guarantee that passive funds must buy the stock immediately, creating instant demand regardless of how the stock actually performs in early trading.

Why this shift matters.

Large private companies now face a structural challenge when going public. They're often bigger than many companies already in public indexes. Their early investors hold massive positions that create selling pressure. Traditional lockup periods and limited initial trading can cause wild price swings.

The solution isn't trying to time the market better. It's building guaranteed demand directly into the structure of the offering. If index rules can be negotiated to force buying, then exit risk drops significantly.

The companies that succeed won't just be the ones with the strongest businesses. They'll be the ones that best navigate the rule-making process.

Investor Signal

Index inclusion is becoming engineered liquidity. Rule-setting and eligibility design now rival fundamentals in determining exit viability and timing.

FROM OUR PARTNERS

Urgent Briefing: How to Get Pre-IPO Access to a $30 Billion Company

A deeply connected venture capitalist with ties to both Silicon Valley and the Pentagon has just released a confidential video briefing — and it’s already drawing major attention.

Inside, he reveals how everyday investors can gain exposure to a fast-growing $30 billion company before it goes public.

No private accounts.

No special connections.

You can access this pre-IPO opportunity right from a regular brokerage account.

All you need is the four-letter ticker symbol revealed in the briefing.

Pre-IPO positioning is often where the biggest gains happen — and access may not stay open long.

THE PLAYBOOK

Evaluate exits based on who must buy, not who might

Consider index eligibility as a liquidity factor for late-stage positions

Track strategic and sovereign anchor capital behind infrastructure assets

Assess whether portfolio companies connect to major platform networks

Prefer sponsors with captive funds that can absorb assets regardless of market conditions

Test any strategy that assumes open-market liquidity will be available on schedule

THE PMD REPOSITION

Private markets aren't repricing growth potential. They're repricing exit access.

Rules, relationships, platforms, and private funds are changing how capital moves. Liquidity is shifting from something markets discover to something large participants build in advance.

This determines who gets funded, who gets time, and who can exit smoothly.

PMD is positioned for markets where advantage comes from channel access, not optimism, and where exits are designed, not hoped for.