In late 2025, policy is not a backdrop. It is the operating system

MARKET PULSE

The political calendar is beginning to collide with the business calendar in ways that are harder to hedge.

Healthcare is staring at a near term pricing cliff. Cannabis is being pulled into federal scheduling and reimbursement debates that could redraw an entire industry’s cost structure. AI infrastructure is running into the physical world, where permitting and power timelines determine who scales and who stalls.

Global logistics is being pulled back into great power bargaining, where assets that looked commercial last year now read like leverage.

What looks like noise is actually a single theme: the rules that determine who gets to build, who gets reimbursed, and who controls chokepoints are tightening at the same time.

For private markets, this is not just politics. It is underwriting.

PREMIER FEATURE

Your Entire Portfolio is Dangerously Exposed…

If you own ZERO of the Next Magnificent Seven stocks.

Original Mag Seven turned $7,000 into $1.18 million.

But these seven AI stocks could do it in 6 years (not 20).

Now, the man who called Nvidia in 2005 is revealing details on all seven for FREE.

Find Out More Now Before It's Too Late.

QUICK BRIEFS: ACA SUBSIDY CLIFF | TRUMP’S CANNABIS RECLASSIFICATION | PERMITTING REFORM FOR AI INFRASTRUCTURE

HOUSE GOP LEADERS CLOSE THE DOOR ON AN ACA SUBSIDY COMPROMISE

Republican leadership is signaling it will not give centrists a clean pressure release valve on Affordable Care Act subsidies before year end, even as swing district members warn about the political fallout.

If enhanced marketplace subsidies expire, millions of households face sharp premium increases and some face loss of eligibility altogether.

The immediate risk is not abstract. It is a consumer level price shock that hits in January, with open enrollment timing compressing the ability to patch it later.

The larger signal is structural. A program that has become embedded in household budgeting is being treated as a negotiation chip inside leadership politics. That is how reimbursement risk gets repriced.

Investor Signal

Healthcare demand does not disappear when subsidies tighten. It migrates. The winners are the platforms positioned for churn, recapture, and plan switching. The losers are models that assume policy continuity in payer mix and member retention.

TRUMP FLOATS A MARIJUANA RECLASSIFICATION THAT PULLS CANNABIS INTO THE HEALTHCARE SYSTEM

The administration is signaling a potential two part shift: tougher fentanyl framing on one side, and a push to reclassify marijuana to Schedule III on the other, with discussion of a Medicare pilot for cannabinoid products.

If rescheduling happens, the first order effects are operational: research barriers ease, tax treatment improves, and banking access expands.

But the second order effects matter more. A reimbursement pathway, even limited, changes who can fund trials, who can distribute at scale, and who gets to set standards.

This is where politics meets industry structure. The moment coverage enters the conversation, institutional capital starts underwriting the supply chain, and incumbents in pharma and distribution begin circling the category.

Investor Signal

If cannabis becomes a reimbursable medical pathway, the sector stops trading like a retail novelty and starts consolidating like healthcare. Expect a wave of acquisition targets to emerge around branded products, compliant supply, and clinical data generation. The fragile spot is liability and evidence standards.

THE SPEED ACT ADVANCES, PUTTING NEPA REFORM AT THE CENTER OF THE AI BUILDOUT

The House is moving legislation backed by major tech and infrastructure stakeholders to tighten permitting timelines and limit the ability of NEPA litigation to stall projects for years.

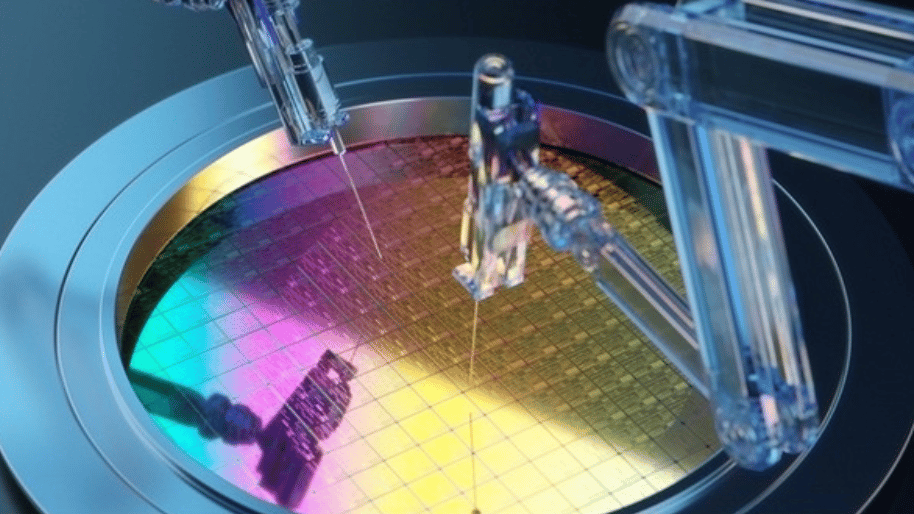

This is not a niche process fight. AI infrastructure is a physical race now. Data centers, transmission, generation, and semiconductor capacity live on multi year timelines, and permitting friction is becoming a decisive bottleneck.

The political irony is the point. The same parties that disagree on climate and energy are being pulled toward the same conclusion: if the United States wants to scale AI, it has to rebuild the permitting machine, even if that means redefining environmental leverage in the process.

Investor Signal

Permitting speed is a competitive advantage. The next winners in AI infrastructure will be developers and operators who can secure interconnection, permits, and power contracts faster than the models can improve. The risk is backlash, where accelerated timelines produce litigation and local resistance in new forms.

FROM OUR PARTNERS

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

DEEP DIVE

THE PANAMA PORTS STALEMATE SHOWS HOW COMMERCIAL ASSETS BECOME STATE BARGAINING CHIPS

The proposed sale of dozens of ports, including two at the Panama Canal, was supposed to be a clean transaction: a BlackRock led group and Mediterranean Shipping Co. buying assets from CK Hutchison.

Beijing is now pushing for Cosco to receive a controlling stake and veto rights as a condition for approval. That demand is not just about economics. It is about governance and leverage. A minority stake can be priced. Control turns ports into policy.

The White House is signaling it cannot accept Chinese control at the canal. China is signaling it can block the deal if Cosco is excluded or limited.

CK Hutchison is left operating the assets while the transaction hangs, and the canal continues to carry a material share of U.S. container traffic.

This is what the new era looks like. Financial sponsors want clean ownership. Shipping operators want operational certainty. States want influence over nodes that sit inside national security narratives and tariff negotiations.

Even if this specific deal fails, the lesson is durable: global logistics assets are no longer treated as neutral infrastructure. They are treated as bargaining chips that can be traded against unrelated issues like tariffs, sanctions, and market access.

The second layer is competitive. If Cosco is barred from bidding on new canal adjacent concessions because it is state owned, and if it simultaneously pushes for control through merger approvals, the market is being reshaped through process, not price. Regulatory leverage becomes a parallel channel to capital.

For private markets, this changes how exits and governance are underwritten. Ownership is not just a cap table question anymore. It is a permissions question.

Investor Signal

Ports, rails, and chokepoints are entering the same category as chips and energy. Strategic infrastructure is investable, but it is not fully ownable in the old sense. The best risk adjusted exposure will come through structures designed for sovereignty constraints: partnerships, minority governance protections, and exit paths that assume political review.

FROM OUR PARTNERS

Breaking News: Trump Unlocks $21 Trillion for Everyday Americans?

President Trump just signed a new law…

That could unlock $21 trillion for everyday folks like you… And potentially impact every checking and savings account in America.

Click here now because Chase, Bank of America, Citigroup, Wells Fargo, and U.S. Bancorp…

Are already preparing for what could be the biggest change to our financial system in 54 years.

THE PLAYBOOK

This afternoon’s theme is simple: politics is no longer downstream of markets.

Subsidies determine consumer pricing power. Scheduling determines who gets to operate inside healthcare. Permits determine whether AI scales in reality or stays in slide decks. Ports determine who controls the flow of trade when negotiations tighten.

The private market edge is not predicting the next headline. It is underwriting the permissions layer.

In 2026, the question will keep repeating in different disguises: who is allowed to build, who is allowed to sell, and who is allowed to control the chokepoints.