The AI cycle is now constrained by gas, oil, minerals, and baseload electrons

MARKET PULSE

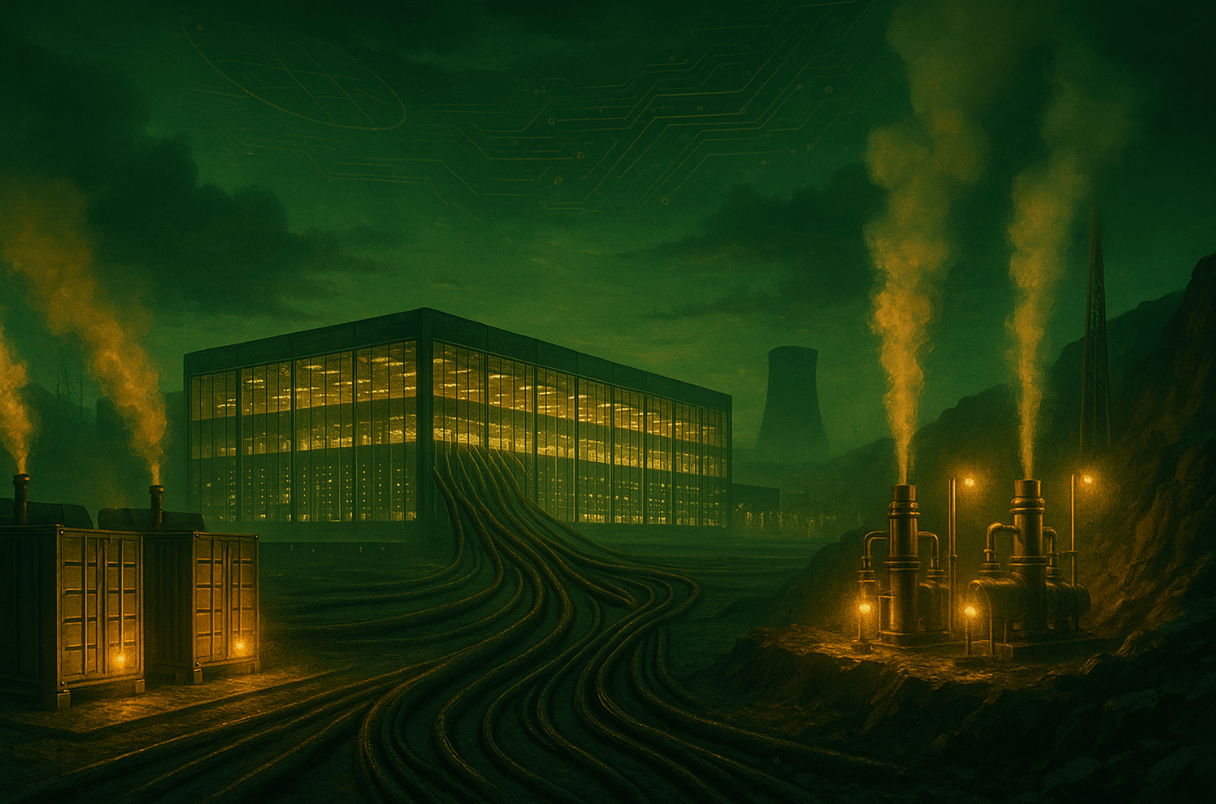

The AI boom now runs on fuel. Not just code. Not just silicon. Real power.

Data centers are straining grids. Utilities are behind. Permits move slowly. Politics moves fast.

And capital is chasing anything that can deliver firm electricity at scale.

Natural gas prices are unstable. Oil supply is building offshore. Nuclear is back in fashion.

Geothermal is suddenly a favorite. Even space is on the table.

This is no longer a tech buildout.

It is an energy and infrastructure cycle wearing an AI headline.

Today’s signal is where that power is coming from.

FROM OUR PARTNERS

Triple the Market’s Dividend + Explosive AI Growth… Still Trading for $5?

This dividend-paying manufacturer just dropped a bombshell: AI server revenue is projected to surpass iPhone revenue within 24 months.

✔ Builds most of Nvidia’s AI servers

✔ Pays nearly 3X the S&P 500 dividend

✔ $30+ billion in AI revenue projected THIS YEAR

✔ Yet the stock still trades for around $5

While other tech names struggle, this hidden AI dividend gem keeps climbing.

Alexander Green calls it his “Single-Stock Retirement Play.”

QUICK BRIEFS

NATURAL GAS PRICES ARE MOVING WITH WEATHER, NOT WITH AI YET

Natural gas prices fell 7 percent on both Monday and Tuesday after peaking near $5.30 late last week. That was the highest level in more than two years. Prices are still up more than 25 percent for the year.

The driver is not data centers. It is weather and exports.

Cold forecasts lifted prices. Warmer forecasts pushed them back down.

The U.S. is exporting record LNG volumes to Europe and Asia. Those buyers will pay more than U.S. consumers. That keeps a floor under domestic pricing even when demand softens at home.

Natural gas is now the largest source of U.S. electricity. When prices spike, utilities respond fast. Some power producers have already shifted back toward coal this year. Consumers are looking harder at heat pumps and electric heating.

Investor Signal

Gas remains the fastest power bridge for AI and data centers. But it is also the most politically fragile. Export demand, weather swings, and fuel switching all cap margin stability. Gas will carry the early load, but it will not anchor the full cycle.

A BILLION-BARREL OIL GLUT IS SITTING AT SEA

There are now about 1.4 billion barrels of oil “on the water.” That is roughly 24 percent above normal seasonal levels. A large share comes from sanctioned Russian, Iranian, and Venezuelan supply that cannot easily find buyers.

OPEC+ is also increasing production. So are Brazil, Guyana, and the U.S.

Supply is rising. Prices are not falling.

The reason is politics. Sanctions make it hard to count what is truly available. China is quietly stockpiling oil as insurance. If that crude had landed at U.S. hubs, prices would already look broken.

The market is frozen between visible oversupply and invisible demand.

Investor Signal

Energy pricing is now shaped as much by sanctions and shadow flows as by fundamentals. For power-intensive industries like AI, oil does not directly fuel the servers. But it drives geopolitical risk, freight costs, plastics, and backup generation economics. Energy inflation remains one policy decision away from reappearing.

STARTUPS RACE TO BREAK CHINA’S HOLD ON CRITICAL MINERALS

U.S. startups are now processing rocks like gabbro to extract aluminum, magnesium, titanium, and other metals long dominated by China. Venture capital is funding the push. Washington is backing it with state money and strategic deals.

China still controls much of the world’s supply of these materials. It also controls much of the processing. That is the choke point.

New firms are betting that cost discipline and automation can make domestic supply work this time. Not because it is greener. Because it is safer.

AI hardware depends on an uninterrupted flow of specialty metals. So does aerospace. So does defense.

Investor Signal

Critical minerals are no longer a clean-energy story. They are now a national security asset. The return profile will be slower and more political. But demand is no longer optional. It is structural.

FROM OUR PARTNERS

The 7 Stocks Built to Outlast the Market

Some stocks are built for a quarter… others for a lifetime.

Our 7 Stocks to Buy and Hold Forever report reveals companies with the strength to deliver year after year - through recessions, rate hikes, and even the next crash.

One is a tech leader with a 15% payout ratio - leaving decades of room for dividend growth.

Another is a utility that’s paid every quarter for 96 years straight.

And that’s not all - we’ve included 5 more companies that treat payouts as high priority.

These are the stocks that anchor portfolios and keep paying.

This is your chance to see all 7 names and tickers - from a consumer staples powerhouse with 20 years of outperformance to a healthcare leader with 61 years of payout hikes.

DEEP DIVE

HOW THE AI BOOM IS REALLY BEING POWERED

The visible face of AI is software.

The real driver is electricity.

Every major branch of new power is now being pulled into the same orbit.

Natural gas.

Geothermal.

Nuclear.

Even orbital power.

This is what the next infrastructure cycle looks like.

Boom Supersonic Turns Jet Engines Into Power Plants

Boom Supersonic just raised $300 million to commercialize a stationary natural gas turbine.

Its first customer is Crusoe, a fast-growing data center developer.

Crusoe will buy 29 turbines for roughly $1.25 billion. That will deliver more than 1.2 gigawatts of power. Deliveries begin in 2027.

The turbines are containerized. They arrive like hardware.

Crusoe handles hookups, pollution controls, and grid links.

Boom wants to manufacture 1 gigawatt of turbines in 2028. Two in 2029. Four in 2030.

Profits from the turbines will fund Boom’s supersonic aircraft. The company calls it its Starlink moment.

Gas is still the fastest way to get electrons to servers.

That speed is now reshaping who builds power plants.

Geothermal Moves From Theory to Scale With Fervo

Fervo Energy just raised $462 million from investors including Google and Breakthrough Energy.

It has now raised about $1.5 billion total.

The company is spending over $2 billion to build the world’s largest enhanced geothermal project in Utah. When complete, the site is expected to power more than 375,000 homes. It could go much higher.

Fervo drills deep into hot granite. It fracks the rock.

It circulates water. It runs a turbine.

Google already uses Fervo power for data centers in Nevada.

Meta is developing geothermal with other partners in New Mexico.

Unlike nuclear, geothermal can come online in two to three years.

That speed is why it now sits at the center of AI power strategy.

Nuclear Capital Floods Back Into the Market

Nearly $2 billion of venture money has flowed into nuclear fission startups this year.

X-energy raised $700 million. TerraPower raised $650 million.

Small modular reactors are the focus.

Data centers are the demand.

Politically, nuclear has regained favor.

Permitting is being fast-tracked.

Public markets have followed with SPAC deals and listings.

This is not the 1970s again.

But the scale ambition rhymes.

Orbital Data Centers Are No Longer Science Fiction

Starcloud has already launched an Nvidia H100 GPU into orbit.

It is now running AI models in space.

The long-term plan is a 5-gigawatt orbital data center powered by constant solar energy. No night cycle. No grid bottlenecks.

SpaceX is openly exploring its own space-based data center plans.

Elon Musk has said this could become one of the largest drivers of SpaceX’s valuation.

Google is studying orbital solar as well.

This is extreme.

But it is happening for a simple reason.

Power on Earth is becoming scarce at the margin.

The Real Pattern

All of these paths point to the same compression point.

AI demand is growing faster than power systems were built to support.

Utilities cannot move that fast.

Permitting cannot move that fast.

Politics moves unpredictably.

So capital is building parallel power.

Gas in containers.

Geothermal in granite.

Small nuclear near campuses.

Solar in orbit.

The power stack is becoming as engineered as the compute stack.

Investor Signal

The central risk in AI is no longer just model progress or pricing pressure.

It is energy access.

Every credible hyperscaler now treats power as a first-order input, not a background utility.

The cost of compute is becoming the cost of electrons plus policy.

Returns will flow to platforms that control both.

FROM OUR PARTNERS

The Crypto That Survived the Crash—and Came Out Stronger

The market doesn’t care if you’re experienced or new — if you’re trading blind, it will take your money.

Adam Mesh, one of America’s most recognized traders, has seen it happen over and over. After selling his company for millions, he came out of retirement to share the strategy that protects him from getting wiped out.

In this free 43-minute training, Adam reveals how he’s generating income even in today’s unpredictable market.

THE PLAYBOOK

This phase of the cycle is being shaped by physical limits, not digital ones.

AI growth is colliding with grid capacity.

Natural gas provides speed but not permanence.

Geothermal provides permanence but requires scale.

Nuclear provides scale but demands patience.

Space removes scarcity but adds new risk.

The common shift is that power is no longer passive.

It is now strategic.

Markets are still pricing AI as a software story.

Capital is already treating it as an energy story.

That gap will not last.