Capital stayed active this year, but only structures built to absorb delay and friction held their ground.

What Held, What Cracked, What Carries Forward

Private markets did not have a dramatic year.

They had a revealing one.

With public markets closed today, this is a good moment to step back from daily noise and look at what 2025 actually clarified. Not predictions. Not performance tables. Just what the year taught capital that was paying attention.

The defining feature of 2025 was not fear or exuberance. It was friction.

Capital was available, but progress slowed. Projects moved forward, but only where they cleared real-world constraints.

Returns still existed, but they increasingly belonged to patience rather than speed.

This was the year private markets learned where theory ends and structure begins.

PREMIER FEATURE

Before the AI Wealth Gap Widens, See This List

Inside: a top-10 dividend payer rolling out AI-powered logistics across 200 countries… a $300B titan embedding AI across its full product stack… and a semiconductor leader still trading 15% below its 52-week high.

All proven operators, all using AI to widen their lead.

See the list for free today, after that, you’ll have to pay.

The Capital Environment That Defined the Year

Money did not disappear in 2025. It became selective.

Rates stayed restrictive longer than most investors expected. Liquidity never froze, but it flowed through narrower channels.

Capital was willing to invest, but it demanded visibility on timelines, permissions, and durability. Growth capital became conditional rather than abundant by default.

The key shift was not price. It was clearance.

Across infrastructure, AI, healthcare, energy, logistics, and real assets, investors ran into the same obstacle repeatedly.

Demand was present. Capital was present. What failed to keep up was the system that turns capital into operating reality.

Permits slowed projects that looked inevitable on paper. Power availability dictated which data centers could actually be built. Regulatory review reshaped ownership structures. Policy decisions stretched into multi-year processes that refused to resolve cleanly.

Private markets are accustomed to operating ahead of public scrutiny. In 2025, many discovered that operating ahead of physical, regulatory, and political constraints is harder.

The market adjusted accordingly. Timelines lengthened. Return expectations shifted. And capital learned to price patience explicitly.

What Worked Quietly

The strongest performers of 2025 did not look exciting.

They looked prepared.

Cash was not idle. It was optionality. Investors who held liquidity were able to move deliberately, negotiate from strength, and avoid forced decisions.

In a year defined by friction, flexibility mattered more than exposure.

Assets with predictable cash flow held up well. Not because growth accelerated, but because reliability became scarce.

Infrastructure with replacement value, platforms embedded in reimbursement systems, landowners controlling power, water, or access rights, and businesses with contractual revenue all benefited from this shift.

Secondary markets provided another signal. Liquidity events occurred, but they were orderly.

Stakes changed hands at adjusted prices without widespread distress. This was not panic. It was maturation. Capital learned to recycle rather than liquidate.

Sponsors with conservative leverage avoided drama. They spent time improving operations rather than negotiating extensions.

Those with aggressive capital stacks spent the year managing lenders, revising timelines, and defending assumptions.

The quiet lesson of 2025 was simple. In an environment with friction, survival with discipline compounds.

FROM OUR PARTNERS

The New #1 Stock in the World?

A tiny company now holds 250 patents tied to what some call the most important tech breakthrough since the silicon chip in 1958.

Using this technology, it just set a new world speed record — pushing the limits of next-generation electronics.

Nvidia has already partnered with this firm to bring its tech into advanced AI systems.

This little-known company could soon become impossible to ignore.

What Cracked or Stalled

What struggled in 2025 was not innovation.

It was overconfidence in smooth execution.

Business models that assumed easy refinancing ran into trouble when timelines stretched.

Roll-ups discovered that integration risk does not disappear simply because spreadsheets say it should.

Capital-intensive growth exposed balance sheets when payback periods moved outward.

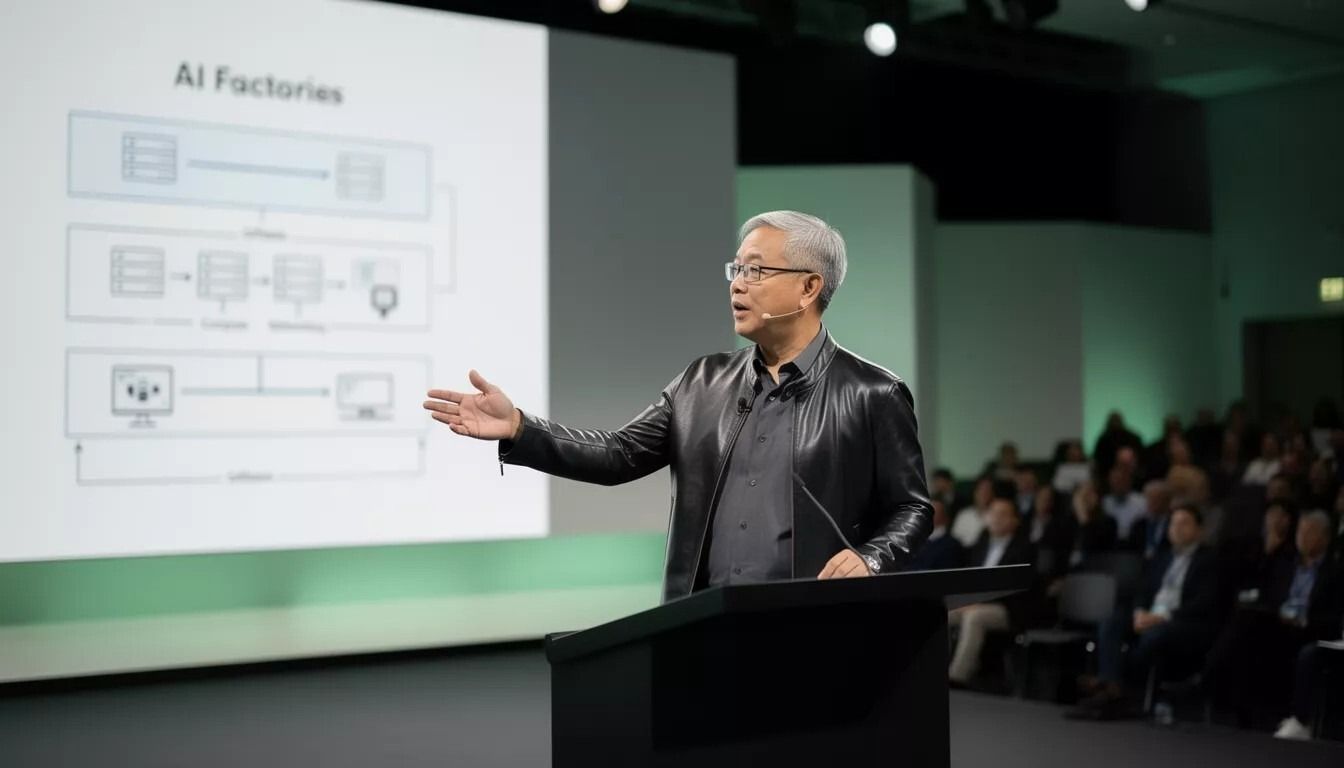

AI offered a clear example. Demand exploded. So did costs. Compute, power, and infrastructure expenses rose alongside usage.

For many companies, scale brought pressure rather than leverage.

Growth that once looked software-like began to resemble utility economics, with margins compressed by physical inputs.

Renewables learned a similar lesson. Even assets labeled critical can stall when permitting, litigation, or national-security concerns intervene.

Duration risk repriced quickly when cash flows became political variables rather than engineering ones.

Healthcare and cannabis revealed another pattern. Policy shifts unlocked opportunity but invited scrutiny.

Tax relief, reclassification, and reimbursement pathways attracted institutional capital, but also imposed standards. Margins normalized. Competition intensified. Scale mattered more than branding.

Nothing collapsed suddenly. But many assumptions stopped holding.

The Shift Most Investors Underestimated

The most important change in 2025 was subtle.

Time became the dominant risk factor.

Not defaults. Not demand. Time.

Policy outcomes took longer. Permits stretched. Courts delayed resolution. Infrastructure cleared slowly.

Capital learned that waiting is not free when costs accrue, attention drifts, and certainty decays.

Markets adapted. Uncertainty itself became monetizable. Companies sold future claims for cash today. Ownership structures changed to absorb delay. Public listings reappeared not as celebrations, but as refinancing mechanisms.

This was not pessimism. It was realism.

Private markets stopped asking whether outcomes would arrive and started pricing how long they would take, how conditional they would be, and how messy the process might become.

That shift favors endurance over precision.

FROM OUR PARTNERS

President Trump Just Privatized The U.S. Dollar

A controversial new law (S.1582) just gave a small group of private companies legal authority to create a new form of government-authorized money.

Today, I can reveal how to use this new money… why it's set to make early investors' fortunes, and what to do before the wealth transfer begins on January 15th if you want to profit.

What Discipline Actually Looked Like in 2025

One underappreciated feature of the year was behavioral.

The most successful investors did less, not more.

They passed on deals that looked good but required perfect timing.

They slowed deployment even when capital was available.

They accepted lower headline returns in exchange for cleaner structures and clearer downside protection.

This restraint was not fear-driven. It was informed by experience. Many had seen cycles where speed was rewarded. 2025 was not one of them.

Instead, discipline showed up in smaller position sizes, fewer assumptions embedded in underwriting, and greater emphasis on who controlled the asset rather than how fast it could grow.

This is not a temporary posture. It is a recognition that the next phase of private markets will reward those who can stay invested through uncertainty rather than those who attempt to trade around it.

What 2026 Inherits

The new year does not reset the board.

It inherits constraints already in place.

Power remains scarce. Permitting remains slow. Regulation remains selective.

AI demand continues, but infrastructure dictates who scales.

Healthcare reimbursement remains political.

Energy supply remains uneven.

Global growth persists, but it is distributed rather than synchronized.

Macro conditions may ease. Rates may fall. That will help. But it will not restore frictionless growth.

The opportunity set increasingly favors assets that convert long holding periods into stability rather than risk.

Structures that do not require perfect timing to work. Businesses that function even when timelines slip and execution is uneven.

Capital that can tolerate delay without stress will have an advantage. Capital that depends on precision will continue to struggle.

This is not a cycle that rewards urgency. It rewards preparation.

FROM OUR PARTNERS

The AI Stock 6 Tech Giants Are Buying

Twenty years ago, $7,000 spread across the original Magnificent Seven could be worth $1.18 million today.

Now, the famous investor who called 4 of the best performing stocks of the last 20 years says:

And one of them recently pulled off something insane...

Apple, Nvidia, Google, Intel, Samsung and AMD have ALL bought shares of this company.

The same analyst who found Nvidia at $1.10 (split-adjusted) is now revealing the details — including all seven stocks he believes could lead the next AI wave.

Closing Lens

Private markets in 2025 did not lose their edge.

They clarified it.

The advantage is no longer being early to the story.

It is being positioned to endure the middle.

The years where systems exist, demand exists, but permission is conditional and progress is uneven.

Capital that understands this does not rush. It builds around constraint. It prices time honestly.

And it compounds quietly while others wait for clarity that arrives later than expected.

That is the lesson this year leaves behind.