Governance pressure, physical scarcity, and exit friction are forcing private capital to prioritize duration, control, and infrastructure over liquidity.

MARKET PULSE

Private markets are being reshaped by constraints that no longer clear through price alone.

Exit timelines are stretching, governance pressure is re-entering sectors once considered insulated, and physical bottlenecks are dictating where capital earns leverage.

Banking activism shows control asserting itself as patience thins.

Copper pricing reveals how infrastructure stress surfaces long before projects deliver returns.

Energy transitions highlight that execution, not policy intent, sets the pace.

In response, private capital is migrating toward assets that convert duration into stability: distribution platforms, real assets, and infrastructure-like revenue streams.

Liquidity is no longer the organizing principle. Control over access, inputs, and end clients is.

PREMIER FEATURE

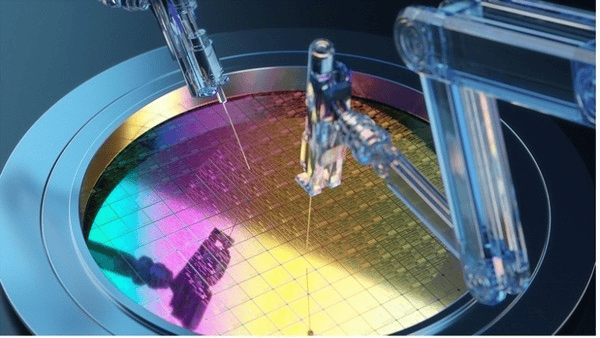

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

QUICK BRIEFS

Activism Enters Banking’s Safe Zone

Bank activism is no longer an anomaly. It’s becoming a strategy.

Campaigns at Comerica, KeyCorp, and peers are not about one-off missteps.

They reflect a sector losing its historical insulation just as returns remain uneven and capital efficiency comes under scrutiny.

Banks that once operated under stewardship logic are now being treated like any other underperforming balance sheet. Activists are pressing for consolidation, asset sales, and capital returns because patience has thinned.

This mirrors stress elsewhere in private markets.

When growth disappoints and duration stretches, capital stops waiting for recovery and starts asserting control. Banking’s perceived immunity to governance intervention is eroding precisely as regulation steps back.

Investor Signal

Governance pressure is migrating into sectors once protected by regulation. Control is becoming the release valve when returns stall. Stability no longer guarantees independence.

Copper Prices Expose Infrastructure’s Real Bottleneck

Copper is doing the signaling before the projects break ground.

This is not a commodity cycle. It is an infrastructure constraint surfacing through price.

Demand is not optional. Supply is regulated, delayed, and expensive to expand. That imbalance rewards owners of long-lived assets, not short-term positioning.

For private markets, this clarifies where leverage is earned. Scarce inputs convert duration into pricing power.

Returns accrue to capital that can hold through development timelines and regulatory friction, not to capital dependent on fast exits.

Investor Signal

Infrastructure stress is clearing through materials first. Scarcity is embedding pricing leverage upstream. Duration is becoming a competitive asset.

Energy Transition Collides With Grid Reality

The transition is no longer ideological. It is mechanical.

At the same time, U.S. grid limits, fuel volatility, and policy reversals pushed coal generation higher and emissions up.

Progress is real, but it is constrained by hardware, not ambition.

Energy outcomes are now dictated by grid capacity, storage economics, fuel access, and balance-sheet strength. Policy can accelerate adoption at the margin, but it cannot override physical systems.

This reinforces a familiar pattern. Transitions reward execution, permanence, and capital that can absorb uneven timelines. The buildout continues, but the path is mechanical, not linear.

Investor Signal

Energy progress is gated by infrastructure, not intention. Capital that funds permanence clears first. Narrative momentum no longer substitutes for execution.

FROM OUR PARTNERS

Less Bitcoin, More Buyers — This Is What Happens Next

For the first time in nearly seven years, less than 15% of all Bitcoin remains on exchanges. At the same time, institutions are accumulating BTC faster than new supply can be mined.

ETFs, corporations, and even governments are tightening the float — creating the conditions for a real supply shock.

When demand overwhelms supply, price pressure doesn’t happen slowly.

It happens suddenly.

That’s why 27 veteran crypto analysts are sharing how they’re positioning ahead of this shift — including where they see opportunity before the next major move unfolds.

DEEP DIVE

Wealth Management’s Roll-Up Cycle Is Converting Distribution into Infrastructure

Control is migrating downstream.

Not into products. Not into performance. Into access.

Wealth management is being consolidated because it sits closest to durable capital.

In a market where exits slow, governance pressure rises, and physical constraints reprice entire sectors, owning distribution is becoming the cleanest way to control duration without taking directional risk.

This is why roll-ups are accelerating. Recurring AUM fees are being treated less like advisory income and more like infrastructure revenue. Predictable, long-dated, and resilient.

The value is not quarterly alpha.

It is persistent proximity to affluent balance sheets when capital everywhere else is stuck waiting.

The logic mirrors what’s happening across the briefs.

Banks are losing their historical insulation as regulation loosens and governance pressure returns. When returns compress, ownership asserts control rather than wait.

Copper prices are signaling scarcity where demand is non-negotiable and supply is slow. Duration holders win.

Energy transitions are advancing, but only where grids, storage, and capital can support them. Execution, not intention, sets the pace.

They are distribution systems in a world where distribution now behaves like infrastructure. That makes them attractive to capital that wants certainty without betting on timing.

But scale alone is not the edge.

Integration is the test.

Retention, advisor alignment, and client trust determine whether consolidation compounds or leaks. This is why deal structures increasingly stretch holds, stagger payouts, and hard-wire incentives. Capital is underwriting patience, not speed.

The quiet shift is this: when exit liquidity becomes unreliable, owning the client relationship becomes the substitute.

Investor Signal

Distribution is being repriced as a control asset, not a growth asset. As exits slow and governance pressure spreads, capital is moving closer to end balance sheets.

The advantage is shifting toward platforms that can hold trust, integrate quietly, and monetize duration without forcing outcomes.

FROM OUR PARTNERS

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

THE PLAYBOOK

This cycle rewards ownership structures built to wait.

As exits slow and volatility persists, private capital must underwrite longer holds, tighter governance, and heavier integration risk.

Control replaces timing as the primary edge. Scarce inputs and infrastructure-linked revenues justify patience, while platforms closest to end demand gain leverage when liquidity thins.

The winners will not be those chasing optionality, but those converting duration into pricing power, access, and resilience.

In private markets, certainty is now manufactured through structure, not speed.