Hospitals are revealing which AI tools survive governance, liability, and procurement… and which ones fail once workflows carry real risk.

MARKET PULSE

Private markets are watching AI collide with environments that cannot tolerate hallucination, downtime, or vague accountability.

Hospitals are emerging as the cleanest stress test: adoption is fast, ROI is measurable, but liability and trust cap what can actually scale.

This same pressure is showing up elsewhere. Banks are monetizing execution, not advice.

AI labs are shifting toward efficiency as compute becomes a permanent cost.

Utilities are valuing AI that runs the system, not decorates it.

The common signal is maturity.

Capital is no longer paying for potential. It is paying for governed performance inside real workflows.

PREMIER FEATURE

The Next AI Leaders Are Forming Right Now

AI winners don’t announce themselves early — they emerge quietly before the crowd notices.

The analyst who called Nvidia back when it was still cheap believes we’re at the start of a similar setup again. This time, he’s identified 7 AI stocks he thinks could lead the next wave — potentially much faster than the last cycle.

QUICK BRIEFS

JPMorgan Turns Internal Playbooks Into a Client Product

Execution has become the scarce input, not capital.

JPMorgan’s launch of Special Advisory Services formalizes something banks have done informally for years.

What’s changed is demand.

Clients navigating AI adoption, cyber risk, real estate decisions, and investor communication are no longer asking for financing alone.

This marks a structural shift. As transformation becomes continuous rather than episodic, operating advantage itself becomes monetizable.

Banks are positioning as operators, not just intermediaries, because value has migrated downstream into implementation.

For private markets, this blurs the line between advisory, consulting, and ownership influence.

When execution determines outcomes, the firm that understands how to run the system gains leverage beyond balance sheets.

The implication is subtle but important.

Competitive advantage is moving away from access to capital and toward access to playbooks.

JPMorgan is packaging execution as a product because clients are willing to pay for fewer mistakes, not more optionality.

Investor Signal

Execution is becoming a priced asset, not a free add-on.

Institutions with embedded operating knowledge gain leverage without deploying capital.

Advice is evolving into infrastructure for decision-making.

Anthropic Bets That Efficiency Will Decide the AI Race

The next AI edge will not come from bigger models. It will come from cheaper ones.

Anthropic’s push toward “doing more with less” reframes the arms race around capability per dollar of compute rather than brute-force scale.

Efficiency becomes a procurement advantage when budgets are fixed and liability is real. In that environment, capital discipline stops being conservative and starts being strategic.

For private markets, this signals a turn. The assumption that AI winners must outspend rivals indefinitely is weakening.

Platforms that can deliver stable performance without escalating infrastructure commitments gain resilience as deployment widens.

The race is shifting from who can build the biggest system to who can run one sustainably.

Investor Signal

Compute is becoming an annuity cost, not a growth lever.

Efficiency is emerging as a competitive moat.

Capital discipline is quietly re-entering the AI leaderboard.

Kraken’s Valuation Shows Where AI Is Actually Being Priced

AI is being valued where it runs the system, not where it dazzles.

Kraken’s $8.65 billion valuation reflects its position inside the operational core of global utilities… billing, customer service, and grid interaction at scale.

This is not an application layer. It is the system of record.

Platforms embedded in high-volume, regulated workflows carry durable contracts, deep switching costs, and accountability that sits with the operator, not the end user.

The market is rewarding AI that behaves like infrastructure, not software.

This is the same pattern emerging in hospitals.

AI that lives inside mission-critical workflows becomes difficult to replace and expensive to dislodge. Value accrues not to novelty, but to reliability under load.

Private markets should recognize this structure early: the highest valuations are attaching to AI that disappears into operations and cannot fail quietly.

The future of AI monetization is procedural, not performative.

Investor Signal

Valuation is migrating to AI that runs core systems.

Infrastructure economics are replacing feature economics.

Control over workflow beats model superiority.

FROM OUR PARTNERS

The Most Boring Crypto Play (That Could Make You Rich)

It doesn’t trend on social media or promise overnight riches.

Instead, this DeFi protocol quietly generates revenue, secures $60+ billion in assets, and is increasingly used by institutions — while its token supply continues to shrink.

Trading around $300, our team believes it has a realistic path toward $3,000+ as new regulations unlock broader participation.

This is the kind of setup that often looks boring — right before it works.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

DEEP DIVE

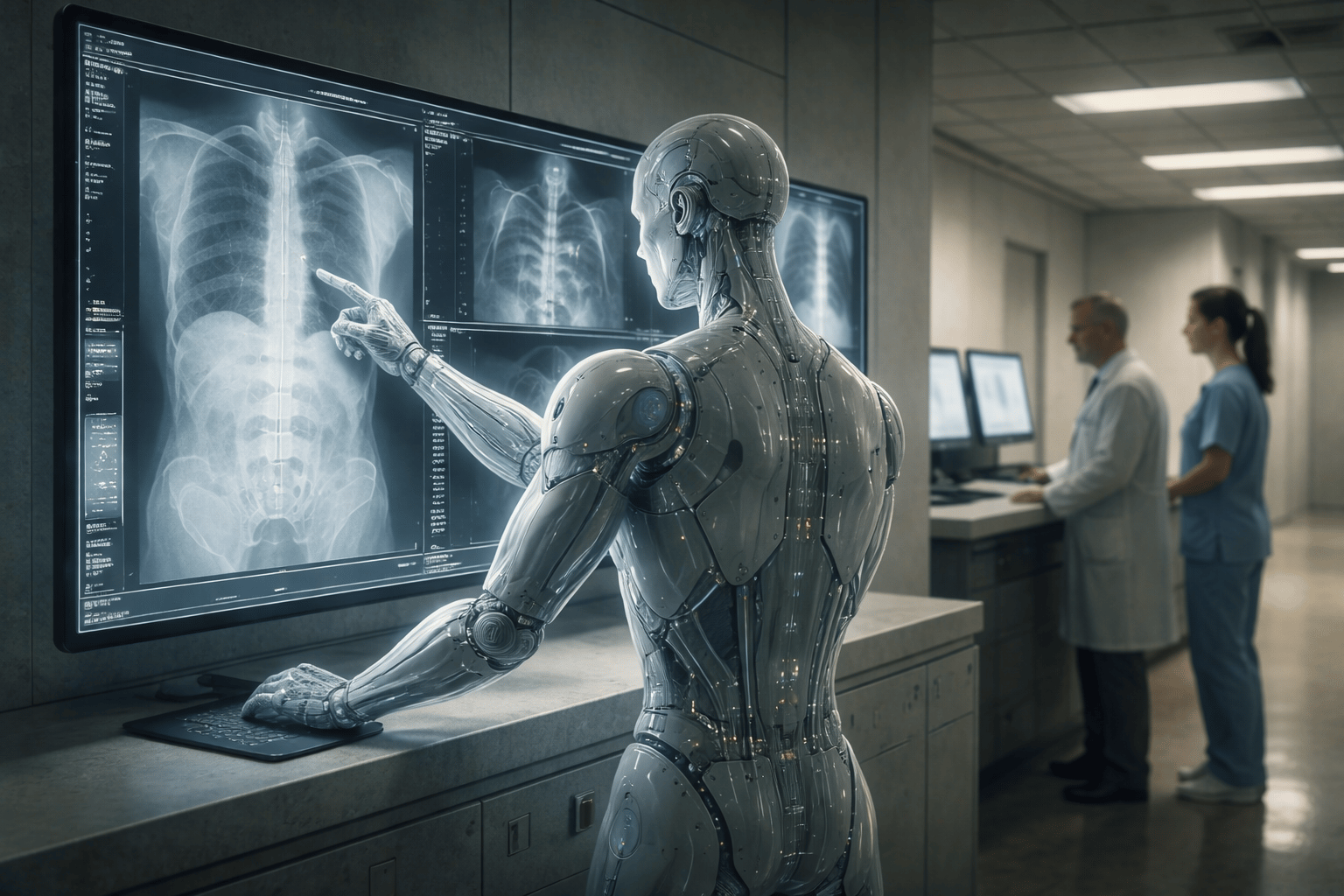

Hospitals Are the First Real Test of AI Credibility

AI does not get infinite retries in a hospital.

That is why healthcare is quietly becoming the most important market in the AI economy.

Labor shortages are chronic. Burnout is entrenched. Reimbursement pressure is tightening.

Any tool that compresses time without adding headcount gets deployed.

And it works… until it doesn’t.

Radiology reads accelerate.

Documentation collapses from hours to minutes. Appeals move faster with fewer staff. These gains are real, measurable, and immediately valuable.

Hallucinated citations are unacceptable. Brittle patient messaging carries liability. Over-reliance quietly degrades clinical judgment when the system becomes the reflex instead of the backstop.

This is AI operating under consequence.

That is why hospitals matter to private markets. They are not early adopters chasing novelty. They are the most demanding enterprise buyers in the economy.

Regulated workflows.

High-stakes decisions.

Long procurement cycles.

Clear accountability when something breaks.

If AI can clear here, it can clear anywhere.

Three structural shifts are emerging.

First, monetization is happening in the least glamorous places.

Documentation, scheduling, call handling, claims appeals. These are repetitive, auditable, and priced by time saved.

ROI is provable, renewable, and contractible. That is where buying decisions stick.

Second, governance is becoming the product.

Reference integrity, audit trails, human override, and performance monitoring are what turn software into something a hospital can defend.

Models without control layers do not scale, no matter how impressive the demo.

Third, deskilling is the long-duration risk.

Automation boosts throughput now but can erode baseline competence later.

Hospitals are beginning to price resilience, not just speed… how systems perform when the tool is unavailable.

Hospitals are not just adopting AI.

They are deciding what kind of AI survives.

Investor Signal

AI credibility is being forged inside governed workflows, not consumer interfaces.

Value is accruing to platforms that can survive liability, procurement, and audit.

In high-stakes markets, control beats capability, and reliability beats novelty.

FROM OUR PARTNERS

When the Fed Cuts, These Go First

They’ve dug through every chart, sector, and earnings trend to find companies positioned for explosive upside once the Fed eases.

From AI innovators to dividend aristocrats, these are the names attracting billions in early institutional money.

Miss them now, and you’ll be chasing the rally later.

THE PLAYBOOK

This phase rewards AI that survives procurement, audit, and removal scenarios.

Tools that reduce labor but degrade judgment will stall. Platforms that prove reliability, traceability, and resilience will compound.

As hospitals, banks, and utilities converge on the same buying logic, private capital is rotating toward AI embedded as operating infrastructure.

The edge is not model brilliance. It is control over workflows where failure has consequences.