FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

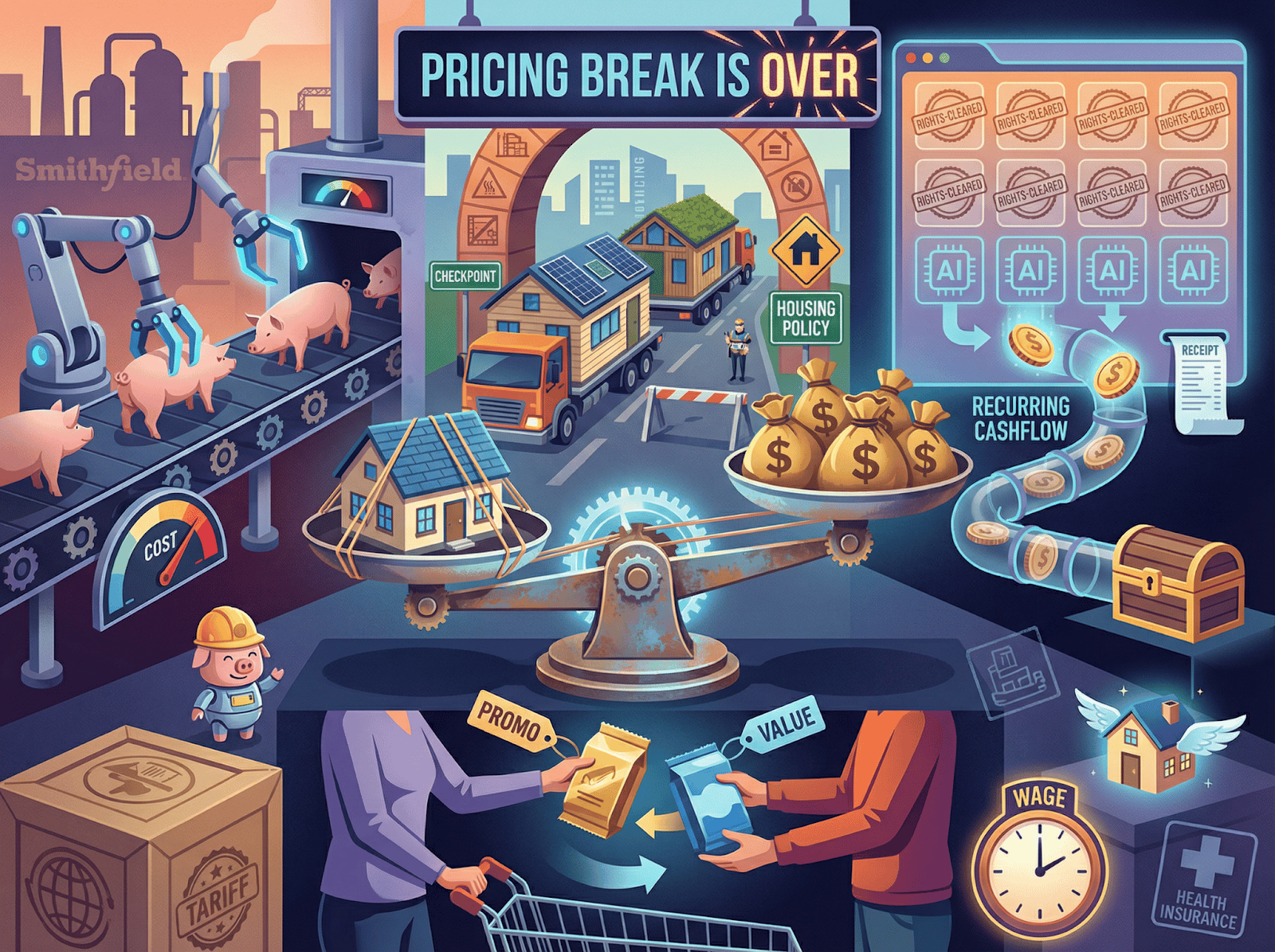

Companies are restarting price increases as tariffs, wages, and health insurance costs compound. Smithfield is committing $1.3B to automated capacity. Housing policy is trying to unlock factory built supply and small dollar mortgage demand. AI content marketplaces are turning licensing rights into a new cash flow layer.

THE SETUP

Markets are reopening with a cautious tone. Tech is heavy again. Yields are drifting lower.

The tape is treating AI as an assumptions trade.

But the micro economy is restarting something investors assumed was fading.

After a brief pause, companies are raising prices again. Not as a one off. As a renewed, broad based pass through cycle tied to tariffs, labor, and benefits.

The point is not the headline CPI path. The point is the input stack that private portfolios actually live inside.

This is where underwriting gets tested. Price increases can protect margins. They can also break volume, shift mix, and expose who has real pricing power versus who was floating on post pandemic demand elasticity.

This matters most in sponsor-owned businesses that refinanced in 2021–2022 at tight spreads under assumptions of stable volume.

Those capital stacks were built for steady demand. A pass-through cycle tests that premise.

When the pricing break ends, the private market question becomes mechanical.

Who can pass costs without losing the customer and who has to buy volume back with discounts?

PMD Lens

Private markets do not reprice on the first sign of cost pressure. They reprice when margin defense fails and leverage stops feeling forgiving.

A renewed pass through cycle does three things at once. It pressures lower end consumers. It forces operating resets inside portfolio companies. And it changes refinancing outcomes because EBITDA quality becomes the fulcrum.

If price-driven EBITDA is masking softening volume, the next refinancing cycle will reprice that risk explicitly.

Tariffs and benefits inflation are especially important because they hit both COGS and opex and they hit persistently. If the portfolio requires constant price lifts to keep margins flat, the lender is effectively underwriting consumer tolerance.

This is not an inflation debate. It is a durability test for pricing power, and a capital structure test for sponsors holding leverage against assumptions of stable volume.

WHAT MOST PEOPLE WILL MISS

The unwind rarely starts with revenue falling. It starts with mix degrading as customers trade down

Health insurance and labor costs behave like recurring taxes inside services and construction portfolios

Tariff driven cost shocks are not evenly passable. They split brands and product tiers

A "successful" price increase can still weaken underwriting if it forces promotions later to regain share

In a pass through cycle, covenant headroom is a function of elasticity, not management narrative

PREMIER FEATURE

10 Stocks for Income and Triple-Digit Potential

Why choose between growth or income when you can have both?

Our new report reveals 10 “Double Engine” stocks, companies built for rising dividends and breakout price gains.

Each has the scale, cash flow, and catalysts to outperform as markets rotate after the Fed’s pivot.

These are portfolio workhorses, reliable payouts today, compounding gains tomorrow.

SIGNALS IN MOTION

The signals below are not forecasts. They are mechanisms already in motion. Each one reveals the same pattern: duration is being financed before economics are fully proven.

Smithfield Commits $1.3B to a New Automated Pork Plant

Smithfield is building a new Sioux Falls facility capable of processing 20,000 hogs a day.

Operators are modernizing and automating because the labor and cost backdrop is not reverting.

Automation is becoming a capital requirement, not a competitive advantage. That raises the bar for smaller, levered operators.

The political scrutiny layer matters too. Foreign ownership narratives can become a friction premium on strategic assets, adding regulatory risk to an already complex capital story.

Investor Signal

Capex is not slowing everywhere. It is being routed into automation and efficiency where volume is durable. For private investors, the question is whether your assets can self fund modernization or whether margin defense depends on price alone.

Congress Moves on Housing Supply With Modular and Manufactured Reforms

Bills are advancing targeting zoning incentives, streamlined reviews, manufactured and modular adoption, and small dollar mortgage access. The politics are secondary.

What matters is whether financing and code constraints that have suppressed factory built housing are actually getting cleared.

If small-dollar mortgage liquidity does not clear, modular remains stranded inventory risk rather than scalable volume.

The PMD angle is not whether the bills pass. It is whether the credit channel clears, because that is what converts legislative intent into investable deal flow.

Investor Signal

If policy can open financing and remove outdated constraints, factory built housing moves from niche to scalable. That creates a new underwriting lane in manufacturing, distribution, and land development, but only if the credit channel truly clears.

FROM OUR PARTNERS

The Surging AI Everyone Wants In On

$60M+ raised. 14,000+ investors. Valuation up 5,000%+ in four years* — yet shares are still just $0.85.

Selected by Adobe Design Fund and insiders from Google, Meta, and Amazon, RAD Intel has its Nasdaq ticker ($RADI) reserved and a leadership team with $9B+ in M&A experience.

A who’s-who of Fortune 1000 brands and top agencies already use its award-winning AI platform, with recurring seven-figure partnerships in place. Sales contracts have doubled in 2025 vs. 2024 as AI consolidation accelerates.

Own the layer everyone will build on.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai

AI Content Marketplaces Emerge as a Licensing Revenue Rail

Microsoft, Amazon, and Factiva are piloting marketplace structures that sell rights-cleared content for AI use.

A marketplace layer standardizes pricing, terms, and usage rights, converting licensing from bespoke deals into repeatable revenue streams.

For smaller publishers, it opens access to enterprise demand they could not reach independently.

Standardized licensing revenue could compress discount rates for smaller publishers by converting episodic settlements into contractable recurring revenue.

Rights are transitioning from a legal defense mechanism to a commercial product with predictable cash flow characteristics.

Investor Signal

Rights are becoming a product, not a lawsuit. Marketplaces convert IP into contractable cash flow and create new infrastructure style businesses in the middle layer.

DEEP DIVE

The Pricing Break Is Over. Pass Through Is Restarting.

This is not a consumer story. It is a portfolio math story.

A renewed pricing cycle means sponsors and lenders are underwriting elasticity again. Tariffs, wages, and health insurance costs are pushing businesses back into price action.

That can stabilize EBITDA, but it also changes the quality of EBITDA because it may come from higher price, lower volume, worse mix, and future promotional givebacks.

The failure sequence is straightforward.

First, costs rise and management pushes price.

Then volume softens at the margin, especially in entry level SKUs and lower income cohorts.

Then mix shifts to premium where possible, but only for brands with real pull.

Then promotions return to protect share.

Then EBITDA becomes noisier and less lendable.

Then refinancing becomes a negotiation rather than a process.

In private markets, this is where leverage stops feeling neutral. If your covenants and maturity walls assume stable demand, a pass through cycle is a slow bleed, not a single shock.

The businesses that survive are not the ones with the best story. They are the ones with defensible pricing power, flexible cost structures, and procurement leverage.

Lenders will not underwrite price-driven EBITDA the same way they underwrite volume-driven EBITDA. The distinction matters when spreads widen.

The deterioration is gradual until it is not. Revenue holds. Margins look stable. Then promotions creep back and volume quietly softens. Then working capital stretches and cash conversion worsens. By the time lenders notice, refinancing is already harder.

Investor Signal

The mispriced risk is elasticity under leverage. A pass through cycle can protect margins in the short run, but it raises the probability of mix degradation, promo relapse, and refinancing friction. Underwrite the customer, not the price list.

FROM OUR PARTNERS

How Traders Are Hitting 1,000%+ Memecoin Gains in Days

While Bitcoin takes months to move, memecoins can explode 1,000%+ in a matter of days.

Two analysts on our team have cracked a system for spotting these breakout coins before momentum hits.

Recent wins include 433% in three days, 889% in three days, and even an 8,200% run in just five months.

This isn’t about holding for years, these moves happen fast.

Right now, they’ve identified a new memecoin showing the same early signals as past winners.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

THE PLAYBOOK

Re-underwrite pricing power by SKU tier and customer segment, not at the blended company level

Treat labor and health insurance inflation as persistent opex, not temporary noise

Model a promotion return scenario even if management claims discipline

Stress test covenants using volume down, mix down, and margin flat assumptions, not margin expansion

Prioritize assets with procurement leverage and operational flexibility, not just brand pricing narrative

In financing, reward clean EBITDA and short duration. Penalize price driven EBITDA with soft demand signals

Look for second order winners in automation, factory built supply chains, and rights monetization rails

THE PMD REPOSITION

Private markets are not facing an inflation surprise. They are facing an elasticity audit.

Pass through is returning. That will expose who has real pricing power and who was protected by the last cycle's demand conditions.

Smithfield is a signal that operators are funding efficiency and automation for a world where costs stay sticky. Housing policy is trying to open a factory built volume lane through financing and code changes. AI content marketplaces are turning rights into contractable revenue.

The question is not whether prices rise.

It is whether your portfolio can defend margins without sacrificing the demand foundation that leverage requires.

In the next twelve months, elasticity will matter more than inflation prints.

In this phase, pricing power is the covenant.