A backward looking synthesis of the structural forces that kept reappearing beneath rotating headlines

MARKET PULSE

Last week did not deliver a single dominant shock.

There was no policy surprise, no macro data break, no sudden collapse or surge that reoriented markets overnight.

What it delivered instead was confirmation.

Across capital markets, private transactions, infrastructure investment, and policy signaling, the same pressures surfaced repeatedly. Sometimes loudly. Sometimes quietly. But always pointing in the same direction.

Markets were not reacting to new information.

They were stress testing assumptions.

Growth narratives were audited against balance sheets.

Innovation stories were weighed against physical and regulatory constraints.

Capital availability was evaluated not as an abstract condition, but as a competitive input.

This was not a week about sentiment or fear.

It was a week about endurance.

The signal came not from where prices moved, but from where systems strained, consolidated, or rerouted. What follows is how the pieces fit together.

PREMIER FEATURE

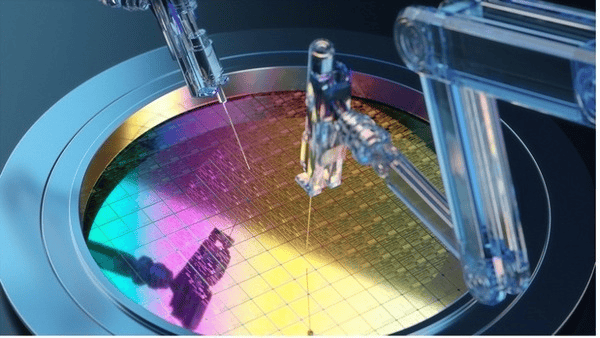

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

THE WEEK IN THREE THEMES

Scale Is Back in Control

One of the clearest throughlines last week was the quiet return of scale as a governing advantage.

In banking and financial infrastructure, consolidation logic resurfaced not because growth is accelerating, but because regulatory and balance sheet math increasingly favors size. Compliance costs, capital requirements, and liquidity buffers are now easier to absorb inside larger platforms. Fragmentation has become expensive.

That same logic appeared in cloud and AI infrastructure. Capital expenditure is no longer optional at scale. Compute, power, and data center buildouts require long duration funding and operational leverage that smaller players struggle to sustain. Oracle’s cloud posture, and the market’s scrutiny of its financing stack, reflected this shift. Demand was not in question. Endurance was.

Even at the model layer, scale signaled credibility. OpenAI’s latest model release was not treated as a feature upgrade. It was read as proof of continued capital access and organizational capacity to execute at frontier scale. In this phase, leadership is less about novelty and more about staying power.

Across sectors, the same pattern held. Fragmented systems are giving way to fewer, larger platforms that can absorb volatility, regulation, and capital intensity simultaneously. This is not a return to exuberance. It is a return to consolidation as risk management.

Models Are Straining Under New Volatility

Another recurring signal last week was stress inside systems that previously thrived under stability.

Quantitative strategies recalibrated as volatility regimes shifted. High profile model adjustments underscored a broader truth. Models optimized for smooth distributions struggle when correlations break, liquidity thins at the margins, and micro moves dominate surface calm.

This was visible in equity markets. Indexes appeared orderly, even muted. Beneath them, individual names experienced sharp dislocations driven by positioning, crowd behavior, and narrative compression. Meme stock episodes were not isolated anomalies. They were symptoms of a market where liquidity and attention move faster than structure.

The parallel to AI was difficult to miss. Automation outperforms humans in narrow tasks, but misses context under regime change. Markets are now experiencing the same tension. Systems built for efficiency are encountering environments that demand judgment.

This is not model failure. It is regime transition.

Markets are relearning that optimization works best under stable assumptions. When those assumptions shift, discretion, governance, and human oversight regain value. That repricing was subtle, but persistent throughout the week.

Capital Access Is Becoming Strategic Again

The most consequential theme running beneath last week’s stories was the reemergence of capital access as a strategic differentiator.

Policy developments signaled this clearly. Legislative efforts aimed at reshaping capital formation are not about stimulating demand. They are about controlling throughput. Who gets funded. How long it takes. Under what oversight.

At the same time, private markets are discovering the limits of staying private indefinitely. Capital pools are no longer expanding. Limited partners are prioritizing liquidity. Funding rounds are reaching sizes that resemble infrastructure finance rather than venture investment.

AI and energy buildouts crystallized this tension. These are no longer software cycles. They are capital systems. Power, land, permitting, and financing capacity determine outcomes as much as technology does. The ability to secure long duration capital on acceptable terms is now a competitive moat.

Capital is not scarce in aggregate.

It is scarce in the places where it must be patient, regulated, and resilient.

That distinction is reshaping valuation, governance, and exit logic across private markets.

FROM OUR PARTNERS

How to Claim Your Stake in SpaceX with $500

Every week Elon Musk is sending about 60 more satellites into orbit.

Tech legend Jeff Brown believes he’s building what will be the world’s first global communications carrier.

He predicts this will be Elon’s next trillion-dollar business.

And when it goes public, you could cash out with the biggest payout of your life.

DEEP DIVE

Viewed together, the week’s deep dives told a consistent story.

Growth was present. Demand existed. Innovation continued. None of those were the binding constraints.

The bottlenecks were elsewhere.

Human judgment became scarce as AI systems scaled faster than organizations could govern them.

Infrastructure projects strained against permitting timelines, power availability, and financing discipline.

Energy transitions relied on legacy cash flows to fund future optionality.

Capital formation increasingly depended on jurisdictional clearance and policy tolerance.

These were not isolated stories about labor, energy, or technology. They were different expressions of the same system dynamic. Modern markets are running into physical, regulatory, and financial limits that cannot be bypassed by narrative alone.

What mattered last week was not what could grow, but what could clear.

INVESTOR SIGNAL

The central takeaway from last week is not directional. It is structural.

Markets are repricing durability.

Balance sheets matter more than roadmaps.

Scale matters more than speed.

Financing endurance matters more than marginal efficiency.

This is not a speculative excess cycle. It is a maturing one. Capital is becoming more selective not because opportunity has vanished, but because constraints are real and cumulative.

Allocators and operators who treat capital access, governance, and system tolerance as core variables will navigate this phase with fewer surprises. Those who continue to underwrite as if funding and permission are background conditions will misprice risk.

FROM OUR PARTNERS

The Most Important Company in the World by Next Year?

Silicon is dead. And one tiny company just killed it.

CLOSING LENS

Last week did not change the direction of markets.

It clarified the terrain.

Capital still moves. Innovation still compounds. Demand still exists. But the system they operate within is tightening around affordability, endurance, and permission.

Markets are no longer organized around optimism versus pessimism. They are organizing around what can be financed, governed, and sustained at scale.

That is not a warning.

It is information.

Understanding that shift is now a prerequisite for operating inside private markets, not a differentiated insight.

The headlines rotated last week.

The system did not.