A backward-looking synthesis of the constraint that kept reappearing beneath unrelated headlines

MARKET PULSE

Last week did not deliver a defining shock.

There was no macro break, no policy resolution, no sudden repricing that forced markets to reorient in real time. Headlines rotated across energy, AI, global trade, and autonomy, but price action remained largely composed.

That composure was the tell.

Markets were not reacting.

They were filtering.

Across sectors, the same dynamic surfaced repeatedly. Demand existed. Capital was available. Technology worked. Yet progress slowed, stalled, or rerouted at the same points.

The pressure was not economic.

It was operational.

Projects advanced where permission cleared.

They paused where timelines became political.

They repriced where execution risk replaced narrative certainty.

This was not a week about what markets believed.

It was a week about what markets were allowed to do.

Seen together, the stories were not about growth accelerating or fading. They were about capability colliding with clearance, and about how quickly markets now discover the difference.

PREMIER FEATURE

Nvidia’s Secret Partner... This Is The New AI Chip Powerhouse

I bet you've never heard of it... but this newly public company is set to become key to Nvidia’s seat on the AI throne. And for now... you can get in while it's still cheap.

THE WEEK IN THREE THEMES

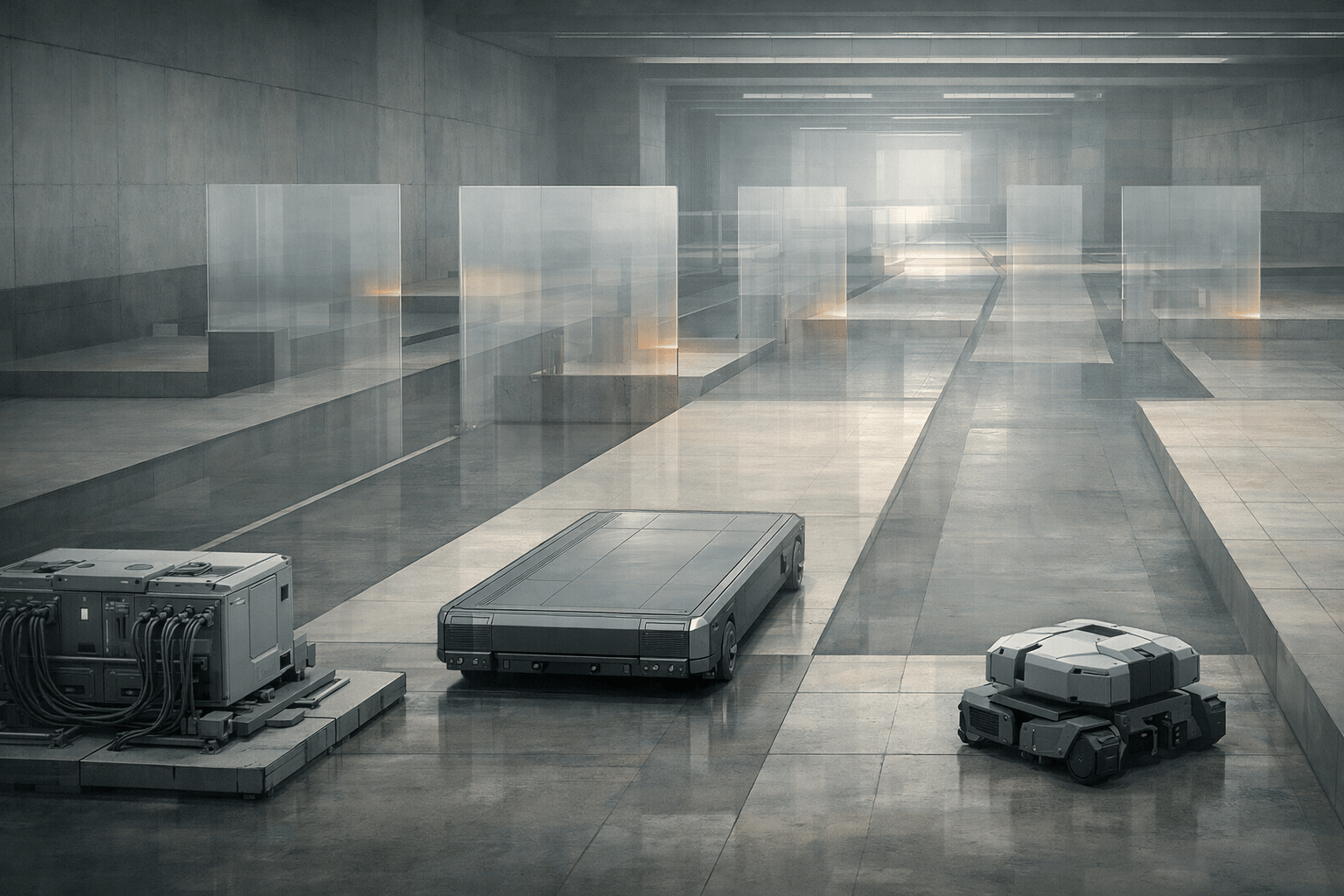

Clearance Is Replacing Capability as the Constraint

The most consistent signal last week was how often progress stopped not because systems failed, but because they could not clear.

Energy provided the clearest examples. Offshore wind did not stall due to lack of demand or capital. It stalled because national security framing redefined the approval pathway.

Reliable generation became valuable not for its technology, but for its ability to operate inside permitting and political tolerance.

The same dynamic appeared in AI infrastructure.

Hyperscalers moved to verticalize power and site development not to innovate faster, but to reduce dependency on grid queues, interconnection delays, and third-party timelines.

Owning the path mattered more than owning the idea.

Even autonomy followed this pattern. Robotaxis demonstrated technical capability, yet repeatedly paused under weather events, power outages, and regulatory scrutiny. The systems worked. The environment did not cooperate.

Across sectors, the edge shifted from who could build to who could clear. Capability is widespread. Permission is not.

Once that distinction becomes visible, it is difficult to unsee.

Time Is Being Repriced as a Financial Variable

Another force cutting across last week’s stories was how aggressively markets repriced time itself.

Policy uncertainty did not freeze capital. It restructured it. When outcomes stretched without resolution, markets stopped waiting for truth and started discounting duration. Tariff refund claims, delayed enforcement schedules, and probabilistic productivity assumptions all turned timelines into tradable inputs.

Ownership structures adjusted accordingly. Going private was no longer about leverage or secrecy.

It was about buying room to operate while clarity lagged. Capital sought structures that could absorb waiting without being forced to explain it quarter by quarter.

This extended beyond policy. Global growth appeared calm precisely because adjustment had already occurred. Capital rotated across regions and supply chains instead of accelerating within them. Stability masked motion.

Time was no longer neutral.

It was priced, transferred, and hedged.

Markets did not demand faster answers last week. They demanded compensation for not getting them.

Scale Now Wins by Carrying Friction, Not Just Cost

The third recurring signal was the quiet redefinition of scale.

Scale no longer dominated simply because it lowered unit costs or amplified distribution. It won because it could carry friction.

Compliance overhead, documentation burdens, power access, regulatory scrutiny, and operational redundancy increasingly favored larger platforms.

Trade policy made this explicit. When customs enforcement turned into continuous friction rather than headline bans, large operators adapted while smaller participants absorbed delays, losses, and uncertainty. Clearance became a fixed cost.

AI infrastructure echoed the same lesson. Capital intensity, long payback periods, and balance-sheet strain separated those who monetize demand from those who must finance it.

Scale mattered, but only when paired with financing endurance.

This was not a return to bigness for its own sake. It was a return to scale as a buffer against constraint.

Markets were not rewarding ambition.

They were rewarding survivability.

FROM OUR PARTNERS

STOP! Don't buy any more Bitcoin

According to former hedge fund manager Larry Benedict, there's an unusual way to play the Bitcoin markets…

And you don't have to invest a dime in Bitcoin!

You could receive regular profits of up to $4,898 or more…

DEEP DIVE

Viewed together, the week’s deep dives pointed to a consistent conclusion.

Growth was present. Demand existed. Innovation continued. None of these were the binding constraints.

What limited outcomes was clearance.

Energy assets repriced around deliverable reliability, not transition narratives. AI infrastructure strained against power, land, and financing timelines.

Policy outcomes mattered less than how long resolution took. Autonomous systems proved capable but fragile under compounded stress.

These were not separate bottlenecks. They were expressions of the same system reality.

Modern markets are increasingly constrained not by what can be imagined or funded, but by what can operate continuously under physical, regulatory, and political pressure.

Last week was not about what could grow.

It was about what could function.

FROM OUR PARTNERS

Apple’s Starlink Update Sparks Huge Earning Opportunity

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone hit 50M+ users even before global satellite coverage. With SpaceX eliminating "dead zones", Mode's earning technology can now reach billions more, putting them a step closer to potential IPO.

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. The offering is only open to accredited investors.

CLOSING LENS

Last week did not change the direction of markets.

It clarified the terrain.

Capital still moves. Innovation still advances. Demand still exists. But the system organizing those forces is tightening around permission, endurance, and execution.

Markets are no longer structured around optimism versus pessimism. They are structured around clearance versus delay.