After a week of Venezuela risk and Maduro headlines, the real test is operational continuity

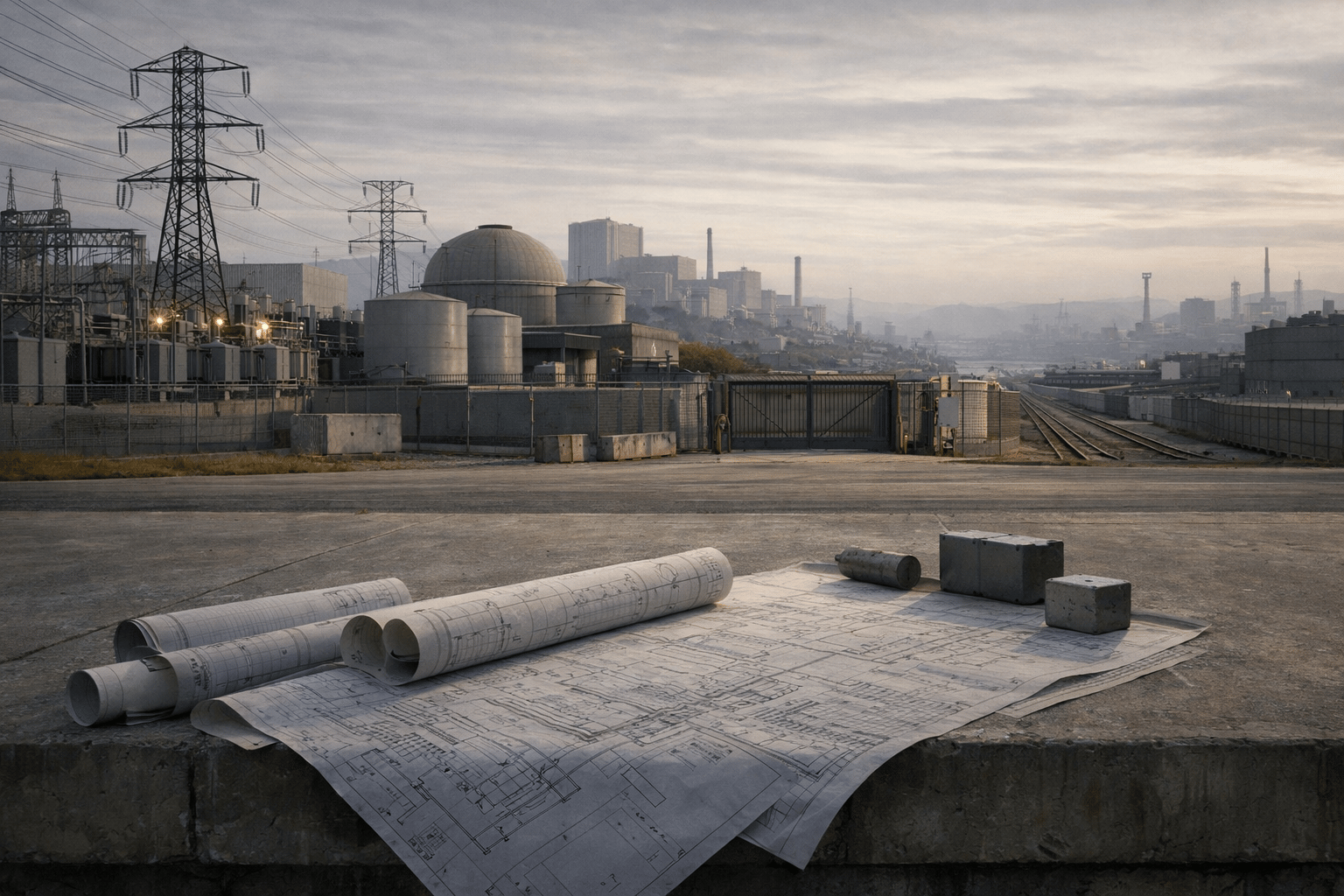

TOP STORY | Venezuela Becomes an Energy Permission Test

The U.S. says it captured Nicolás Maduro in an overnight strike and extraction operation, forcing an immediate succession scramble in Caracas. For markets, the relevance is not political theater. It is whether Venezuelan crude can continue to move through an enforcement regime that has already been tightening tanker behavior and exportability.

Two things can be true at once. Venezuela’s core production and refining infrastructure appears largely intact. At the same time, export flows were already under pressure heading into the operation, with tankers diverting, loadings slowing, and storage building as sanctions enforcement intensified. In that environment, markets are more likely to price logistics and clearance risk than physical supply loss.

That sets up a familiar pattern.

Crude may carry a short-term geopolitical premium, but the more durable signal will come from whether barrels are allowed to clear ports, secure insurance, and reach end markets without friction.

Oil companies with Venezuelan exposure are now being judged less on reserve math and more on operational continuity, licensing durability, and employee safety. Access, not assets, is the variable.

Oilfield services, shipping, and insurers sit one layer upstream. Even without damaged facilities, disrupted routing and hesitant counterparties can tighten effective supply and reprice the chain faster than spot crude itself.

This is not a clean supply shock. It is a permission test.

And it arrives at a moment when markets across energy, credit, and commodities are already rewarding models that function under enforcement rather than assumption.

PREMIER FEATURE

The #1 Memecoin Opportunity to Start the New Year

While the broader crypto market struggled, analysts Brian and Joe kept finding explosive memecoin gains — including 1,100% in 2 days, 600% in a single day, and even 8,200% in months.

These weren’t lucky bets. They use a proprietary system designed to spot memecoins with momentum before they take off — regardless of market conditions.

Now they’ve identified their #1 memecoin for January 2026. It’s still trading at pennies, with viral potential, real utility, and a setup that could thrive if a New Year rally takes hold.

© 2026 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies. Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

MARKET PULSE

Last week did not change the market’s direction.

It clarified how the system is functioning.

Across sectors, the pattern was consistent. Capital remained available. Demand persisted. Innovation continued.

Yet outcomes kept slowing, rerouting, or repricing at the same pressure points.

Projects advanced where permission, inputs, and balance sheets aligned. They stalled where timelines stretched, costs accumulated, or governance uncertainty entered the stack.

That behavior matters more than price action.

Markets were not reacting. They were filtering.

Now the calendar turns to the first full week of 2026 complete with a dense macro slate.

The releases ahead will not introduce a new regime. Their value lies in how they confirm or challenge the same constraint framework that dominated last week’s headlines.

This is not a week that will be defined by surprise.

It will be defined by what clears cleanly and what does not.

The question markets are implicitly asking is not whether growth exists.

It is whether the system can sustain growth without forcing outcomes, repricing risk abruptly, or leaning on optimism to bridge operational gaps.

Three Forces That Will Shape How the Week Is Read

Labor Will Be Interpreted as a Duration Variable

The cluster of labor data due this week will provide one of the clearest tests of whether time itself is becoming a priced input across the economy.

ADP, JOLTs, Initial Jobless Claims, Nonfarm Payrolls, the Unemployment Rate, and Nonfarm Productivity together offer a comprehensive view of labor demand, supply, and throughput. Markets are not positioned for a sudden deterioration. Nor are they pricing a reacceleration that would force policy recalibration.

What matters instead is clearance.

If job openings remain elevated while hiring lags, it reinforces the idea that labor markets are constrained by mismatch and friction rather than demand.

That dynamic pressures margins and stretches payback periods without triggering headline weakness.

It also mirrors what private capital is experiencing elsewhere: capability exists, but execution clears more slowly than expected.

Productivity will play a crucial role in this interpretation.

If productivity gains offset wage growth, firms buy time.

If productivity disappoints, labor becomes a compounding cost that turns duration from neutral to punitive.

In this environment, strong employment data does not automatically support risk. It tests whether systems can operate longer without repricing capital or governance expectations.

Manufacturing and Housing Will Signal Throughput, Not Confidence

ISM Manufacturing PMI and Factory Orders will be read less as growth indicators and more as throughput diagnostics.

Expansion accompanied by rising backlogs, slower deliveries, or inventory accumulation would reinforce the idea that industrial capacity exists but is gated by inputs, logistics, and clearance.

That is consistent with the broader pattern we have seen across AI infrastructure, energy systems, and capital-intensive projects.

Factory Orders that translate cleanly into revenue and cash flow would ease duration pressure. Orders that linger without fulfillment extend it.

Housing data will offer a similar lens. Building Permits and Housing Starts are often treated as sentiment indicators. In the current regime, they are better understood as clearance signals.

Permits without starts point to regulatory, financing, or cost friction. Starts without broad participation reflect access capital constraints rather than confidence.

As last week’s condo example demonstrated, operating costs and carrying friction can quietly turn duration into risk long before prices break.

Housing is not frozen.

It is gated.

Trade and Global Flows Will Reflect Systemic Friction

The Balance of Trade report will provide a snapshot of how global flows are clearing at the start of the year.

Persistent imbalances alongside steady demand would suggest that trade outcomes are being shaped less by consumption and more by operational constraints, supply chain rigidity, and geopolitical friction.

In that case, trade becomes another arena where clearance, not appetite, sets the pace.

Markets increasingly treat global flows as infrastructure problems rather than cyclical adjustments. That framing matters for how capital allocates across regions and platforms with embedded access.

FROM OUR PARTNERS

Buffett, Gates and Bezos Quietly Dumping Stocks—Here's Why

The world's wealthiest individuals are making huge moves with their money.

Warren Buffett just liquidated billions of shares. Bill Gates sold 500,000 shares of Microsoft. Jeff Bezos filed to sell Amazon shares worth $4.8 billion.

What is going on? One multi-millionaire believes they are preparing for a catastrophic event. But not a crash, bank run, or recession. It’s something we haven’t seen in America for more than a century.

Earnings Will Reveal Whether Structure Is Doing the Work

Earnings from Constellation Brands, RPM International, SYNNEX, and Acuity Brands will be read through a structural lens rather than a growth lens.

For consumer-facing businesses, the focus will be on pricing power, cost absorption, and margin durability. Volume alone is no longer sufficient if it cannot be monetized cleanly through higher operating friction.

Industrial and manufacturing-linked firms will be judged on backlog quality, working capital discipline, and cash-flow timing. Orders that convert slowly increase duration risk even when demand remains intact.

Distribution platforms such as SYNNEX sit at a particularly important intersection. When liquidity is available but clearance is uneven, distribution behaves like infrastructure. Balance-sheet depth and scale can convert friction into stability, but only if integration and cost control hold.

Across these earnings, the common question will be whether returns are being generated by the business or by the structure surrounding it. In this regime, that distinction increasingly determines valuation.

Fed Commentary Will Frame the Environment, Not the Path

Speeches from Fed officials including Kashkari, Barkin, Bowman, and Paulson are unlikely to reset expectations in a holiday week.

Markets are less sensitive to guidance and more attentive to whether policymakers acknowledge that labor, housing, and supply constraints are persisting rather than fading.

Recognition that time, clearance, and operating friction have become structural inputs would reinforce the prevailing market posture. Silence would not change it.

The Fed does not need to act for the regime to persist.

It only needs to avoid contradicting it.

FROM OUR PARTNERS

Trump's Secret Retirement Fund

His salary is $400,000 a year. But his tax returns show he collects up to $250,000 a MONTH from one source.

It's not real estate.

It's not stocks.

What the Week Ahead Is Really Testing

Taken together, the coming releases form a single question rather than a checklist.

Can the system continue to function smoothly when growth, demand, and liquidity exist, but clearance remains uneven?

If labor remains strong but slow to clear, manufacturing expands with friction, housing improves without broad access, and earnings confirm that margins depend on structure rather than momentum, the conclusion will be familiar.

Markets are not stalling.

They are adapting to a slower clearing mechanism.

That adaptation favors balance sheets that can absorb delay, ownership structures that can tolerate ambiguity, and platforms that control bottlenecks rather than chase optionality.

It is not a bearish outcome.

It is a selective one.

CLOSING LENS

The first full week of the year is unlikely to deliver a turning point.

It will deliver confirmation.

Capital is still moving. Innovation is still advancing. Demand is still present. But the system organizing those forces is tightening around permission, endurance, and execution.

Markets are no longer structured around optimism versus pessimism.

They are structured around clearance versus friction.

The data ahead will not answer where growth goes next.

It will show how much strain the system can carry while it gets there.

That distinction now defines private markets.

And it is unlikely to fade with the holiday lights.