FOR PEOPLE WHO WANT TO SEE WHAT BREAKS BEFORE IT BREAKS

A stalled investor ban shows how political definition risk is reshaping housing exits, leverage, and buyer pools before any law is passed.

THE SETUP

Markets are opening the week at record levels, but with a very different posture than the headlines suggest.

The tape looks calm. The calendar does not.

The next three sessions bring the data that the shutdown delayed, retail sales, payrolls, CPI, plus an active slate of earnings.

That combination matters because it forces markets to reconcile two realities at once: public marks are behaving as if the system is stable, while the economy is sending mixed signals that require a verdict.

When the verdict is pending, investors do not pull capital. They shorten the leash.

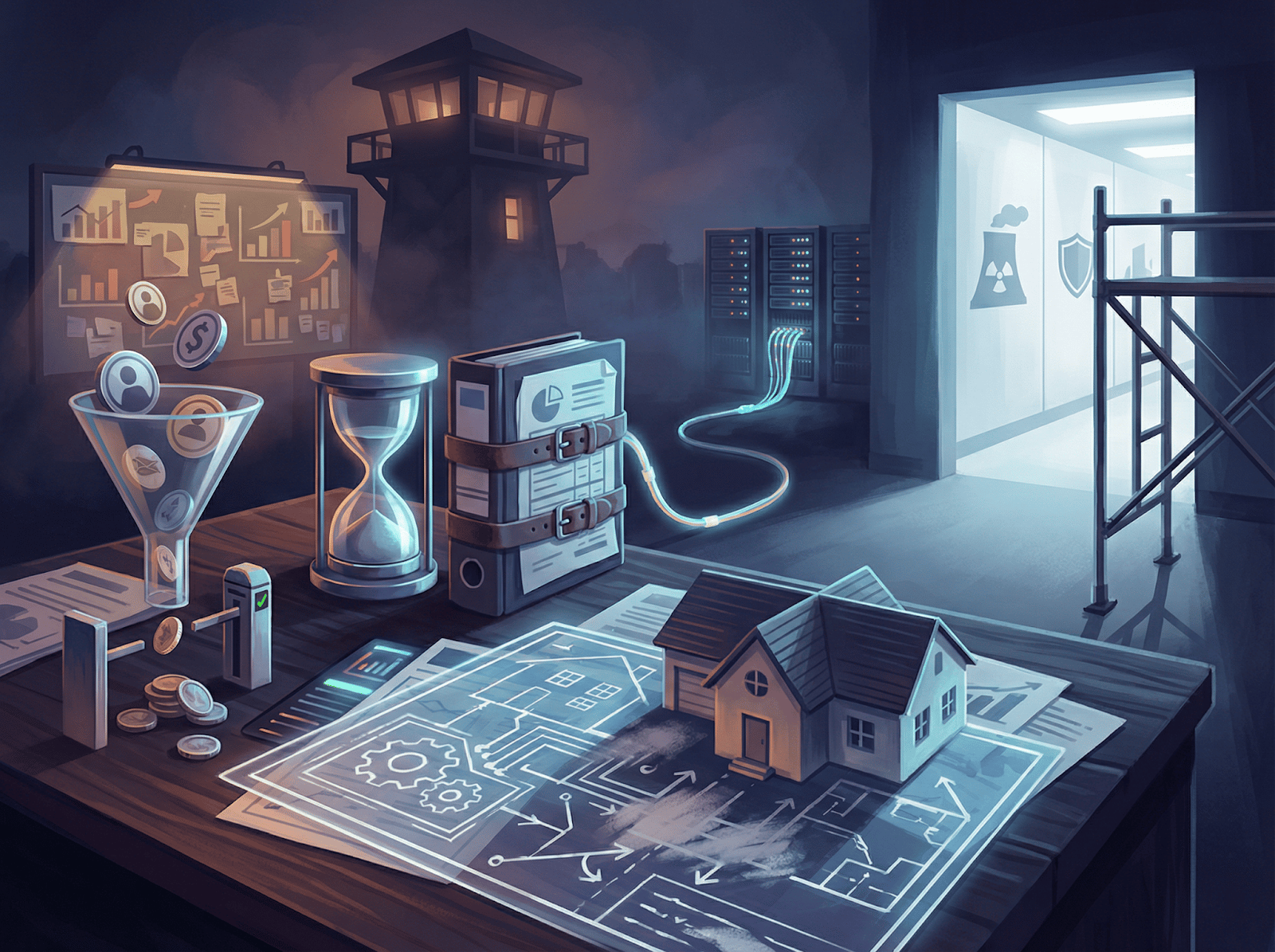

Private markets are feeling that same compression, but through a different channel. The immediate risk is not operating income. It is timing and rule clarity.

When policy definitions, enforcement capacity, and political sensitivity start to move inside the hold period, exits become less automatic, leverage becomes more conditional, and buyer pools become harder to rely on even before any law is passed.

PMD Lens

Private markets do not reprice on headlines. They reprice when assumptions around buyers, leverage, and exit timing stop being reliable.

When ownership, enforcement, or policy clarity becomes uncertain, capital does not retreat. It becomes conditional. Structures thicken. Hold periods stretch. Exit confidence narrows quietly.

WHAT MOST PEOPLE WILL MISS

Policy ambiguity reprices assets before regulation changes

Definition risk shrinks buyer pools without touching cash flow

Exit friction hits IRRs faster than operating income does

Leverage adjusts before fundamentals weaken

Politicized assets lose the benefit of quiet time

PREMIER FEATURE

Why Are These People So Angry?

Marc Lichtenfeld, one of the most trusted voices in income investing, is on the streets of South Florida showing random people something on his phone. One by one, you can see their reactions change almost instantly.

What are they looking at?

Proof of what Marc calls the biggest legal scam in America, one that affects 95% of Americans and has been running for decades.

Marc uncovered the whole thing and isn’t staying quiet about it.

SIGNALS IN MOTION

Duration Risk Is Moving Onto Balance Sheets

Alphabet sold $20 billion in bonds this week to fund AI infrastructure, bringing its long-term debt to $46.5 billion after quadrupling in 2025.

The company flagged risks around "excess capacity" and disclosed entering "significant leasing arrangements" that could increase costs if utilization lags deployment.

CEO Sundar Pichai told analysts that compute capacity keeps him awake at night.

When high-quality borrowers openly price duration risk before proof arrives, the market watches.

This is not a tech story. It is a time-pricing signal.

Capital is being committed to multi-year projects where utilization certainty trails infrastructure spend. The transmission happens through refinancing terms.

Lenders begin treating utilization as a covenant variable when deployment timelines stretch beyond earnings visibility.

The market now charges for time when proof is delayed.

Investor Signal

When capital deployment runs ahead of proof points, time itself becomes a cost. Underwrite duration as a covenant, not an assumption. Expect refinancing friction before earnings deteriorate.

Enforcement Capacity Is Becoming a Market Variable

Former CFTC enforcement director Ian McGinley confirmed what market participants already sense. The agency lacks staffing to police prediction markets effectively as they scale.

CFTC staff has been "significantly reduced" while prediction markets expand from niche hedging tools into mainstream contracts.

They now cover elections, sports, and crypto-linked events. The agency "has yet to bring any enforcement actions" on event contract manipulation. McGinley stated the agency needs "more staffing" to keep pace.

This is not a crypto story. It is an enforceability risk.

Markets can be regulated on paper and under-policed in practice. When prosecution bandwidth thins, counterparties must price integrity risk explicitly.

The transmission runs through spreads and participant screening.

Institutional capital narrows or demands higher compensation when enforcement credibility weakens.

Investor Signal

When prosecution bandwidth shrinks while market complexity grows, enforceability becomes the product. Price integrity risk explicitly. Expect spreads to widen even when volumes appear healthy.

Sponsored Infrastructure Is Reopening Exit Windows

Holtec International filed confidentially for IPO, seeking a valuation above $10 billion.

The nuclear engineering firm already generates over $500 million in annual revenue from decommissioning and spent fuel storage.

The IPO timing ties directly to its Palisades restart in Michigan — the first shuttered U.S. reactor to return to service — backed by $1.5 billion in DOE loan guarantees and $300 million from the state. This is not an IPO story. It is a permissions story.

Nuclear restart capital is clearing because the rulebook is readable: federal support, regulatory approvals, and grid reliability mandates anchor underwriting.

The transmission shows in exit visibility.

Policy-backed infrastructure regains liquidity windows that demand-driven projects lost.

Capital can price time with confidence where the rulebook is clear.

Investor Signal

Permissioned reliability now outranks growth exposure. Where the rulebook is readable, exits can price. Focus on execution and compliance risk, not demand uncertainty.

FROM OUR PARTNERS

$50 Billion Says You’ll Want These Names

Wall Street’s big money is already moving, quietly building positions in a handful of stocks before the next rally.

Our analysts tracked the flows and found 10 companies leading the charge.

Some are household names. Others are under-the-radar innovators about to break out.

Together, they form the Post-Rate-Cut Playbook smart investors are following right now.

DEEP DIVE

When Policy Becomes the Underwriting Variable

Trump signed an executive order in January directing federal agencies to restrict institutional investor access to single-family homes, framing the move as protecting homeownership.

He called on Congress to codify the ban. Congress has not moved. Senate Banking Committee leaders favor alternative housing bills that contain no investor restrictions.

Prior attempts at state and local levels stalled or failed.

The proposal does not need to pass to change underwriting. It only needs to introduce ambiguity around who is allowed to own, finance, and exit these assets tomorrow.

The private-markets sequencing is predictable.

Buyer pools narrow first. Not because investors are leaving, but because potential exclusions create friction.

Definitions remain undefined — Treasury has until mid-February to clarify what constitutes a "large institutional investor" and a "single-family home."

That ambiguity alone forces capital to price who might be excluded. Lenders adjust next. Financing terms tighten as banks underwrite definition risk into loan structures.

If a borrower's exit depends on selling to another institution, and that institution's eligibility is contested, leverage pricing reflects it.

Exit timelines stretch. Fewer potential bidders means slower processes and lower confidence in realized pricing. IRRs compress while cash flows stay intact.

The order does not ban purchases outright or force portfolio sales. It restricts federal program support — Fannie, Freddie, FHA — from facilitating institutional acquisitions.

Many buyers rely on private debt already, limiting immediate mechanical impact. But the signal is louder than the mechanism.

Once "institutional investor" becomes a political category, capital must underwrite who might be excluded tomorrow, not just who owns today. Markets price the ambiguity, not just the rule.

Sponsor support becomes the next casualty.

Private equity backers watch leverage terms tighten and exit windows narrow. They begin repricing their own exposure.

Capital calls slow. Follow-on commitments become conditional.

Portfolio companies that relied on sponsor backstops find those commitments hedged with new covenants tied to regulatory clarity. The cascade does not stop at the asset level. It travels up the capital structure.

LPs start asking questions about political exposure in fund portfolios.

Asset managers face pressure to disclose concentration in politically contested categories.

What began as a housing proposal becomes a portfolio construction constraint.

Housing has not broken. The rulebook has.

Operators still collect rents. Properties still cash flow. What has changed is exit certainty. When ownership becomes politically contestable, the path to liquidity narrows before operations deteriorate.

Time becomes the hidden cost. Hold periods extend. Leverage proceeds shrink. Realized returns erode while operating income looks stable.

This is how policy risk reprices assets. Not through headlines, but through the quiet adjustments capital makes when assumptions stop feeling reliable.

Investor Signal

Housing is no longer priced only on rents and rates. When ownership becomes politically contestable, exit certainty deteriorates before operations do. Time becomes the hidden cost long before fundamentals break.

FROM OUR PARTNERS

The Three Key Men Who Could Ignite The Biggest Gold Bull Run in Over 50 Years

According to Dr. David Eifrig, a former Goldman Sachs VP, three powerful men inside the highest levels of the U.S. government are advancing a strange plan that could impact your wealth in a MAJOR way. And in the process, it could spark the biggest gold frenzy in over half a century.

Dr. Eifrig urges you to move your money to his No. 1 gold stock immediately (1,000% upside potential.) He warns if you wait a second longer, you could get priced out.

THE PLAYBOOK

Underwrite definition risk explicitly in politically targeted asset classes

Treat buyer-pool durability as an assumption, not a constant

Model IRR sensitivity to slower exits and lower leverage proceeds

Favor structures with diversified takeout paths and regulatory neutrality

Price time as a cost when rule clarity deteriorates

Assume exits reprice uncertainty earlier than earnings

THE PMD REPOSITION

Private markets are not repricing on fear.

They are repricing on enforceability and time.

Housing shows it through ownership ambiguity.

AI shows it through duration commitments. Infrastructure shows it through permissioned continuity.

PMD is positioned for a market where the edge is not predicting headlines, but identifying what still clears when the rulebook becomes part of underwriting.